The Centre may ask the Reserve Bank of India (RBI) to cool down bond yields as rising interest rates threaten its borrowing programme for the fiscal.

The Centre has budgeted to raise Rs 14.95 lakh crore through bonds. But revenue losses on account of the recent fuel duty cuts, more inflation busting subsidies and poor capital receipts because of a stalled disinvestment programme could force the government to raise anywhere between Rs 1 lakh crore and Rs 1.5 lakh crore in this financial year.

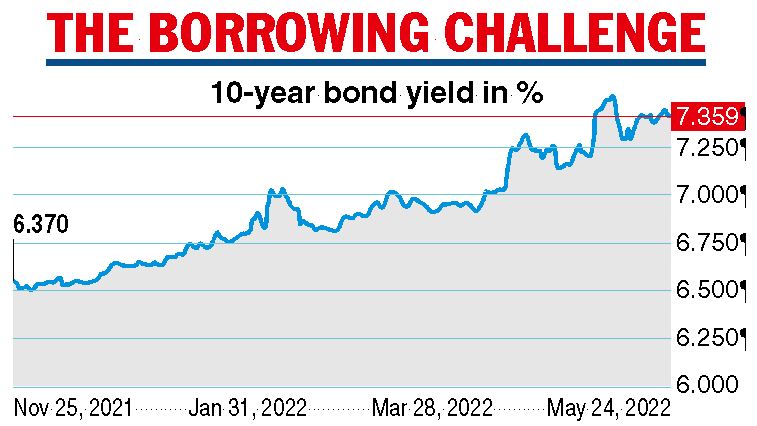

Analysts have forecast the 10-year benchmark yield to hit the 8 per cent mark in this fiscal, if the government takes recourse to additional borrowings.

The 10-year paper on Tuesday settled at nearly 7.36 per cent against the previous close of 7.39 per cent. The yields — which are inversely related to prices — had touched a three-year high of 7.49 per cent after the RBI surprised the markets with a 40-basis-point hike in the repo rate earlier this month.

In an interview with CNBC TV-18, RBI governor Shaktikanta Das said it has various policy instruments at its disposal to tamp down yields such as Operation Twist which involves buying long-end debt while selling short-tenor bonds to keep the yields under check.

Das said globally bond yields have risen because of various factors, and India will not be immune to this trend. The RBI has in the past said it is in favour of orderly evolution of the yield curve.

According to Reuters, the Centre had urged the RBI to either conduct a switch operation or buy back government bonds to cool down yields. After the recent climb in bond yields, the markets have been speculating on an open market operation where the RBI purchases bonds.

Analysts are also not ruling out the possibility of the RBI increasing the limit of held-to-maturity (HTM) of bonds by banks from the present level of 23 per cent to support any higher borrowing programme.

In its April policy, the central bank had the raised HTM limit from 22 per cent as an incentive to banks to purchase bonds. Bonds held in the HTM category do not have to be marked to market, thus saving the portfolio of banks from the vagaries of their price movement.

Government expenditure is expected to go up on account of a rash of relief measures. The Centre last week reduced the excise duty of petrol by Rs 8 per litre and diesel by Rs 6 that will lead to an outgo of Rs 1 lakh crore.

According to the analysts of Bank of Baroda, the additional fertiliser subsidy of Rs 1.1 lakh crore will push up the overall subsidy bill to Rs 4.3 lakh crore, with fertiliser subsidy alone at Rs 2.15 lakh crore.

The plan to provide a subsidy of Rs 200 per gas cylinder (up to 12 cylinders) to around 9 crore beneficiaries of PM Ujjwala Yojna will also cost the exchequer Rs 6,100 crore, the analysts said.

Earlier, on March 26 the government announced the extension of PM-GKAY by another 6 months till September costing the government Rs 80,000 crore. The analysts has forecast the fiscal deficit to rise to 6.6-6.7 per cent of GDP. The government has set a fiscal deficit target of 6.40 per cent for this financial year.