Non-banking finance companies have been under pressure since the collapse of infrastructure lender IL&FS, leading to liquidity constraints in the sector as a whole. Hemant Kanoria, chairman of Srei Infrastructure Finance Ltd, opens up to Sambit Saha of The Telegraph on the NPA malaise plaguing the infrastructure sector, the liquidity crunch and, above all, the broken trust between the government and industry. An excerpt:

How is the liquidity situation for Srei and NBFCs in general?

For NBFCs, from the liquidity perspective, there are two areas that need to be addressed — liquidity to take care of the present liabilities and liquidity to do future business as money is the raw material for NBFCs. For most NBFCs, liquidity to take care of their liabilities was not really a major problem. A few may have faced issues due to asset-liability maturity mismatch but most NBFCs were comfortable in meeting their present liabilities.

Bank funding, however, continues to be muted despite the fact that the government has been urging banks to release funds to NBFCs so that they can grow. While banks are happy to finance companies that are in retail financing, they are hesitant in offering loans to other NBFCs.

At Srei, we have not faced any liquidity issue as we do not borrow short to lend long. We will continue to focus on our profitability and reduce our risks through co-lending programmes with banks.

So, in a way, project financing has stopped completely. Is it because recovery is doubtful and the risk is too much?

We need to understand the project lending philosophy. In project finance, delays are natural because clearances generally do not come on time. Projects inherently need the “time cushion” for completion; therefore the financing plan should be made accordingly. What has happened is that the current guidelines for NBFCs state that if a company does not pay on time, the loan account will be classified as a non-performing asset. In this kind of a situation, it is difficult for NBFCs and even banks to do project financing. For every cash flow delay, if the account is classified as sub-standard and if lenders have to make provisions, they would avoid project financing.

Do you think that there should be separate NPA classification norms for infrastructure projects?

Ideally, there should be separate classification norms for infrastructure projects, manufacturing companies and consumer retail loans. One cannot put everything in the same bucket. NPA provisions have to be aligned with the nature of the business. Unfortunately, the current environment puts all lenders in the same bucket. Earlier, NBFCs had some headroom as the regulator took note of the fact that the business of NBFCs is different from that of banks.

Banks are like generalised organisations, like supermarkets where you will get everything. NBFCs, on the other hand, are specialised institutions. NBFCs take higher credit risks than banks since they have teams that oversee the way their clients’ businesses function.

For instance, we do equipment financing. We understand the business and our recovery methodology for this business is different than that of a bank. So, in our case, we were offering loans to some clients who may have some issues in the past, but since we knew the equipment well and knew how to realise the money through resale, we were comfortable in providing the loans.

There could be some delay, which may be due to circumstances beyond the clients' control, but ultimately we will always get our money back. But now as provisioning norms are same for banks and NBFCs, it is difficult to have such business. At present, banks and NBFCs are not keen to lend to manufacturing companies or finance infrastructure projects unless they are rated “AAA” or “AA”. Only large corporate groups with deep pockets or the government can now set up manufacturing/infrastructure projects.

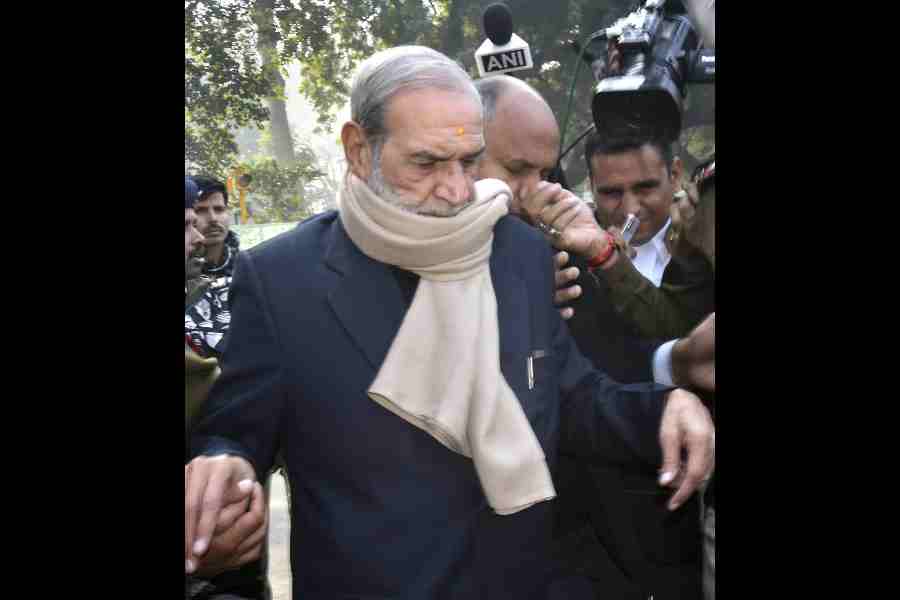

There should be separate classification norms for infra projects, manufacturing companies and consumer retail loans. One cannot put everything in the same bucket. NPA provisions have to be aligned with the nature of the business

Hemant Kanoria, Chairman of Srei Infrastructure Finance

What should be the relaxed NPA norms for the infrastructure sector?

There should not be any relaxation; the norms should only be aligned to the practical aspects of the business. For example, a stress test can be done if an infrastructure project is facing problems; for manufacturing companies one should figure out ways to address the cash flow problem. Restructuring should be allowed because once an account becomes an NPA, no one touches it.

Many a time the delay in payment is because the money is not getting released in time from the government. Does the government always pay on time? Do large companies always pay on time? If not, then why should one downgrade only the recipient every time there is a delay. One should start from the top; you cannot start from the bottom. Smaller companies do not have endless cash flow. Hence, the NPA norms need a revision. Such external factors should be taken into consideration while classifying accounts as standard, substandard and nonperforming.

What else should be done to address the NPA problems?

In my opinion, the NPA issue has been blown out of proportion. In today’s India, most of the companies are classified as NPAs. There is an urgent need to address this issue and arrest failures. Several companies that existed five years ago have ceased to operate. If everyone is a fraud, there must be something wrong in the system. If there is a fraud, the promoters should be taken to task, but efforts should also be made to protect the company. Hundreds and thousands of jobs are at stake. We should protect companies, protect industries.

A practical approach is the need of the hour considering the current macroeconomic situation. A committee can be set up by the Reserve Bank of India which will examine the sectors that are experiencing pain every quarter or once in six months. Accordingly, the provisioning norms for such sectors can be notified. India is not just a country, it is like a continent and, hence, one needs to take into consideration the macro factors. One has to be strict with those who commit fraud but the regulator must review the current NPA provisioning norms and ensure that credit flow continues in the economy. Banks and NBFCs need to be supported and regulations cannot keep getting tightened.

Is there a fear in the system?

Unfortunately, we are not making differentiation between frauds and failures. Moment there is a problem in the business; it is being labelled as fraud. A business might fail because of several factors, most of which are external and beyond anyone’s control. If we are not able to segregate failures from frauds, we will kill the entrepreneurship spirit in our country. No one would want to take risk and do business; everyone will be looking for a job.