Punjab National Bank (PNB) on Tuesday reported a net profit of Rs 247 crore for the three months ended December 2018, reversing a three-quarter losing streak. The state-owned lender was able to post a turnaround on the back of speedier recoveries and a slide in bad loans.

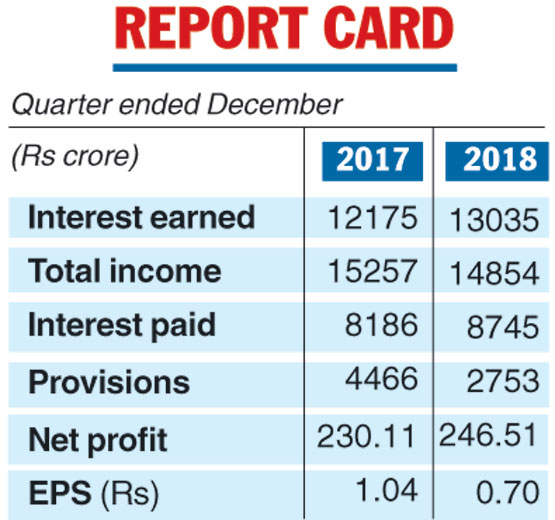

PNB had posted a net profit of Rs 230.11 crore during the similar October-December quarter of the previous fiscal.

In February 2018, a fraud of over Rs 14,000 crore by jeweller duo Nirav Modi and Mehul Choksi had dented the bank’s performance.

“Profitability from operations is going well, the asset quality is improving. Going forward, our provisioning requirement from the one-off incident (fraud) is no more.

“I recall the last incident when we talked to you in February 2018. We were passing through the most turbulent time in banking history. I am happy to announce...that we are back in the black,” PNB managing director and CEO Sunil Mehta told reporters at a press conference here on Tuesday.

PNB had suffered a net loss of Rs 13,416.91 crore for the fourth quarter of 2017-18 — the biggest ever by any domestic lender — after the scam was revealed.

It had posted a net loss of Rs 4,532.35 crore and Rs 940 crore during the second and first quarters of the current fiscal year (2018-19), respectively.

The Telegraph

“We have honoured all our commitments. Our bank, as on date, has provided all for that incident (Nirav Modi fraud). We suffered because of the one-off incident which has now been absorbed by the bank,” Mehta said.

The bank set aside Rs 2,753.84 crore as total provisions, excluding income tax, during the quarter against Rs 4,466.68 crore a year ago.

Provisioning for bad loans stood at Rs 2,565.77 crore against Rs 2,996.42 crore in the year-ago period.

Punjab National Bank also said that in the December quarter, it provided Rs 2,014.04 crore to make full provisions for the fraud detected at its Brady House branch in the March quarter of 2018 .

The bank’s total income fell 2.64 per cent to Rs 14,854.24 crore from Rs 15,257.5 crore in the year-ago quarter.

On PNB’s asset quality, the bank said, its gross non-performing assets (NPAs) as a percentage of total advances rose to 16.33 per cent from 12.11 per cent in the year-ago period. Net NPAs, however, came down to 8.22 per cent from 8.90 per cent at the end of December 2017.