The Economic Offences Wing (EOW) of the Mumbai police on Friday submitted a 32,000-page chargesheet against five persons in the multi-crore Punjab and Maharashtra Cooperative (PMC) Bank scam at a metropolitan magistrate court here.

The chargesheet has named Housing Development and Infrastructure Ltd (HDIL) promoters Rakesh Wadhawan and Sarang Wadhawan apart from the cooperative bank’s former managing director Joy Thomas, former chairman Waryam Singh and former director of the bank Surjit Singh Arora.

The accused have been charged under various sections of the Indian Penal Code, including cheating, fraud, destruction of evidence and falsification of documents.

The chargesheet includes the forensic audit report of the bank and documents of properties purchased by the accused bank officials with alleged kickbacks received by them for giving undue favour to HDIL and the Wadhawans.

The chargesheet has statements of 340 witnesses, including account holders in the bank.

The police had recorded the statements of four crucial witnesses before a magistrate under section 164 of the Criminal Procedure Code.

The EOW action comes days after the Enforcement Directorate (ED) filed a charge sheet against the Wadhawans before a special court set up under the Prevention of Money Laundering Act (PMLA).

They were initially arrested by the EOW, and later taken into custody by the ED.

Twelve people have so far been arrested by the EOW in connection with the scam. Among them, the five who have been named in the EOW chargesheet are at present in judicial custody.

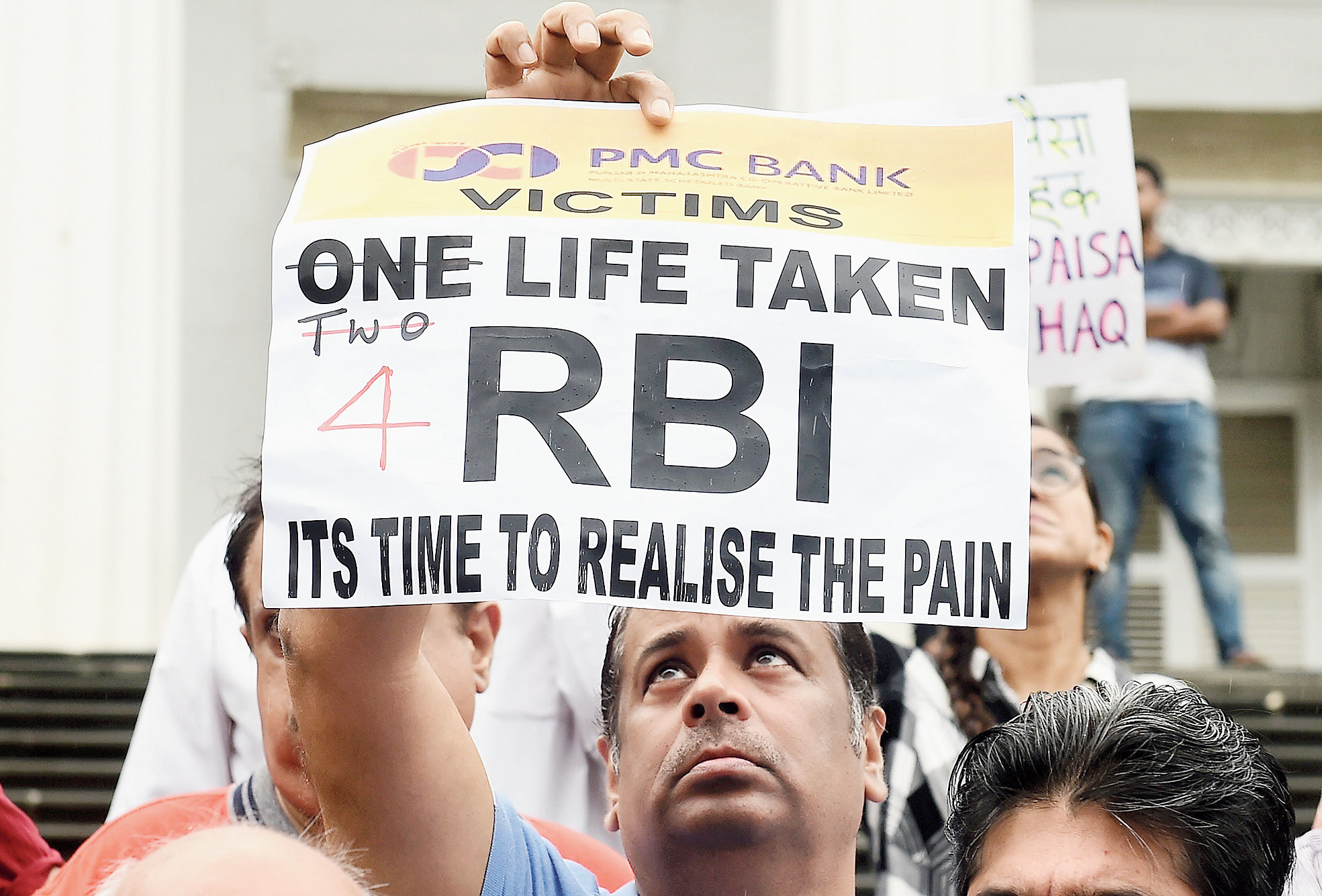

The fraud at PMC Bank came to light in September this year after the Reserve Bank of India (RBI) discovered that the bank had allegedly created fictitious accounts to hide over Rs 6,700 crore in loans extended to HDIL.

The RBI had said that the co-operative bank masked 44 problematic loan accounts, including HDIL loan accounts, by tampering with its core banking system and the accounts were accessible only to limited staff members.

Following the detection of the fraud, the RBI had imposed regulatory restrictions on the bank. The withdrawal limit for account holders of the bank was earlier kept at Rs 1,000, which was increased gradually to Rs 50,000 per account.

Following the PMC scam, the central bank had announced that it will bring urban co-operative banks with assets of Rs 500 crore and above under the Central Repository of Information on Large Credits (CRILC) reporting framework.

The RBI has created this framework which presently includes commercial banks, financial institutions and certain non-banking financial companies, with multiple objectives ranging from strengthening offsite supervision and early recognition of financial distress.