Gold is often seen as a hedge against inflation as well as an investment option for long-term investors.

Traditionally, people invest in gold in the physical form such as jewellery, coins and bars.

This means you carry risks of safe keeping, purity evaluation, and limited liquidity.

Also, investments in physical gold don’t come back to circulation in the economy for long periods of time while gold import accounts for a big chunk of India’s foreign exchange every year.

In 2015, to encourage people to invest in dematerialised gold and to address issues related to gold investment without disturbing investor sentiment, the government launched the Sovereign Gold Bond (SGB).

On January 14, the fifth tranche of the SGB went on sale. The SGB offers the dual benefit of capital appreciation and interest income to the investor, making it an attractive alternative to physical gold.

There are several advantages of investing in SGB in comparison to physical gold.

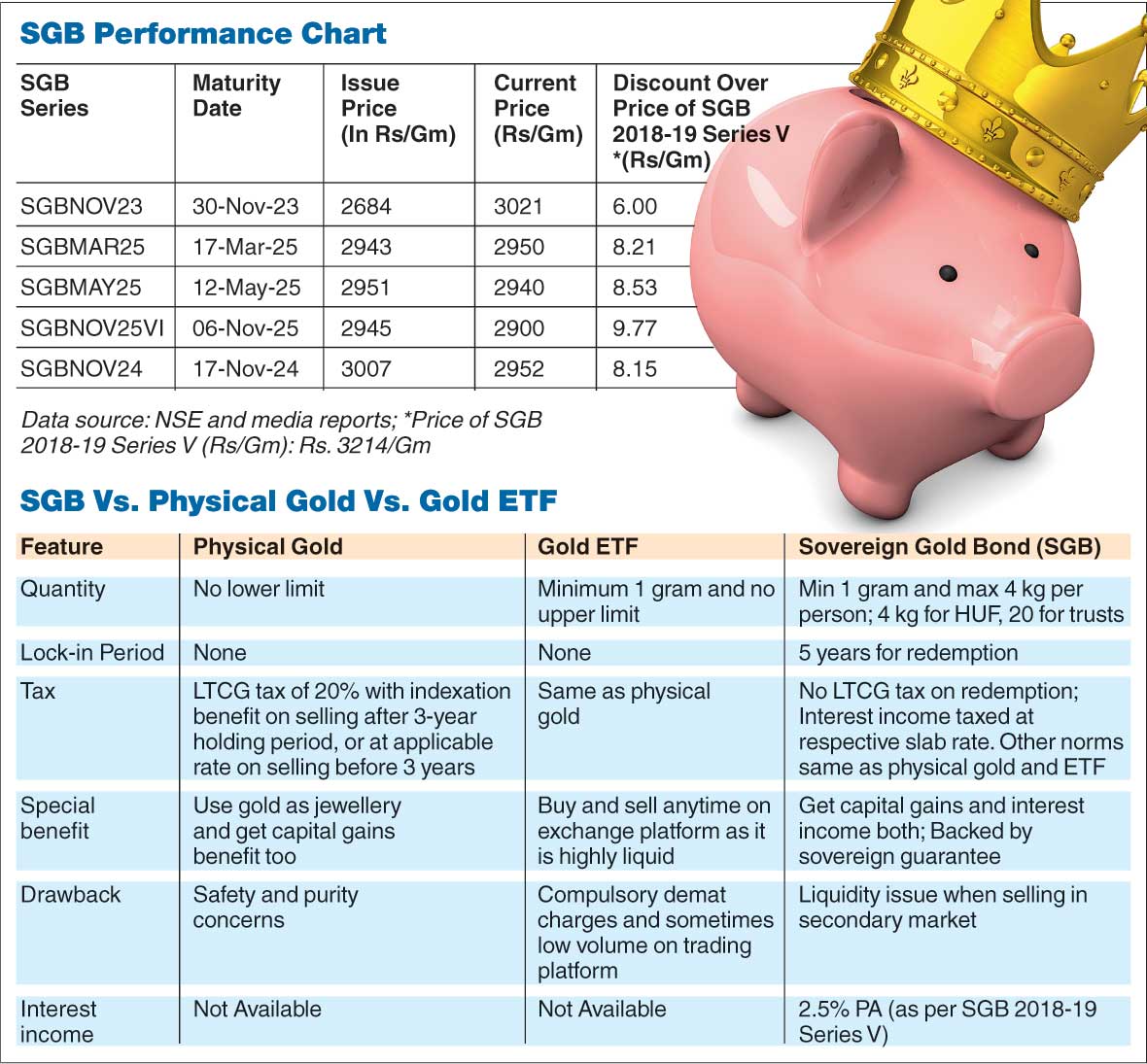

Before you decide on investing in a particular gold product, check out the comparison among SGB, physical gold and gold ETF in the chart above.

New tranche

The SGB 2018-19 Series-V investment window was open from January 14 to 18 with a subscription price of Rs 3,214 per gram. Settlement was on January 22. There is a discount of Rs 50/gram on online applications or making digital payment — effectively priced at Rs 31,64 after discount. The SGB Series-V is offering an interest rate of 2.5 per cent per annum.

Past tranche

SGBs launched in the past are currently trading at an attractive discount in comparison to the price of SGB 2018-19 Series V. Lack of liquidity in the secondary market is one of the key reasons because of which there is a discount in the SGB price. So buying from the secondary market is also a good option that you can explore.

Waiting for maturity

Staying invested in an SGB till redemption is a good idea because at the time of redemption its price would be determined by the average price of 24K gold for the past three days, as published by the Indian Bullion and Jewellers Association Ltd.

So even if the SGB is currently trading at a discount from the prevailing spot price, it would be settled at the prevailing spot rate during redemption.

How to invest

You can invest in the SGB 2018-19 Series V by logging on to your net-banking, through a post office branch, by visiting your bank branch, through your demat platform, or through an authorised stockbroker.

If you are looking to make a lump sum investment, this is a good opportunity to invest in the SGB 2018-19 Series V.

But should you invest?

There are different reasons for people to invest in gold. Some see it as a hedge against inflation. Some buy it for religious reasons or to wear it. Others buy it for investment.

If you are buying gold for investment purposes alone, SGB may be a better option for you compared with physical gold because it is easier to store, does not have concerns about purity, and provides you an interest income over and above capital gains.

However, you must also see the big picture with gold: returns have been flat for several years, and your near-term returns may be less than those from a savings account. Gold as an investment may be useful during economic volatility. But don't compose a large part of your financial portfolio with it.

The writer is CEO, `BankBazaar.com`