In a year marked by complex policy decisions on retail lending comes yet another decision. The government of India recently took the decision to refund some of the interest incurred by small borrowers during the six-month period ending August 2020.

The decision came after weeks of deliberation in the Supreme Court on how to alleviate the burden of the additional interest borrowers must pay following the moratorium.

The almost seven-month long break from EMIs was necessitated by the pandemic which wiped out incomes, making loan repayments impossible for many.

Following the moratorium, we’ve also had the announcement of a one-time loan restructuring scheme for stressed borrowers, and now there’s an interest refund. Let’s make sense of it all.

What is the new scheme?

According to Oxford Dictionary, “ex-gratia” means “as a gift or favour, not because there is a legal duty to do it”. The scheme will grant an ex-gratia payment equal to the difference between the simple interest and compounded interest on eligible loans for the six-month period between March and August.

Lending institutions such as banks and home finance companies will have to pay borrowers this amount by November 5. The taxpayer will foot the bill.

Who is eligible?

The scheme aims to aid small borrowers — even those who hadn’t availed themselves of the moratorium. Therefore, loans from banks, co-operative banks, NBFCs, HFCs, and other eligible lenders,which were standard (not NPAs) as on February 29, 2020, with dues of Rs 2 crore or less on that date, are eligible for the interest refund.

MSME, home, education, automobile, personal, consumer durables, credit card and consumption loan categories are eligible for the scheme. Additionally, you could avail the scheme on multiple eligible loans assuming the total dues is up to Rs 2 crore.

What do you gain?

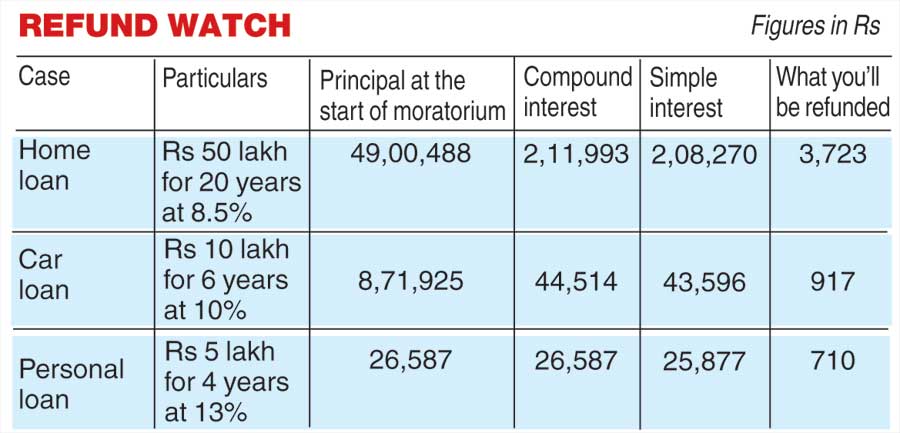

Not much, as it turns out. For most retail loans, the payout would range from a few hundred to a few thousand rupees.

Let’s take the example of a home loan of Rs 50 lakh where the first 12 EMIs have been paid on time and moratorium was availed for EMIs 13 to 18. Assuming the rate of interest to be 8.50 per cent and the tenure to be 20 years, the simple interest for the six months works out to just over Rs 2.08 lakh. The compound interest for the same period is under Rs 2.12 lakh. The borrower will get paid around Rs 3,700, the difference between the two amounts. The lender must deposit the amount in the borrower’s bank account by November 5. Consider this a small Diwali bonus.

The problem remains

Stressed borrowers had to avail the moratorium because their incomes vanished. They still need to find a way to deal with the additional debt that will be created by the deferment of EMIs.

In the above example, if you deferred EMIs 13 to 18, your interest on the whole loan goes up from Rs 54.13 lakh to Rs 65.81 lakh — an additional debt of nearly Rs 12 lakh. The number varies from one loan to another. But the closer you are to the start of your loan, the more the moratorium will cost you. A little interest waiver will provide little respite in the long run. The dues still need to be paid.

Loan restructuring

If you are experiencing income stress, you could also avail yourself the one-time loan restructuring.

The interest waiver scheme and the restructuring scheme aren’t at odds with each other. You could benefit from both.What both schemes have in common is that your loan needs to be standard at the end of February. If you were in default by then, you can’t avail either scheme.

How to erase additional debt?

To deal with the interest on interest, you must have a bounce-back plan.

To simplify the math using the above example of Rs 50 lakh, if you pre-paid 120 per cent of your deferred EMIs within 12 months of the last deferred EMI, you could wipe out most if not all the additional interest you were going to pay.

Pre-paying regularly in any way would help you close the loan sooner and provide tremendous interest savings in the long run.

While the government has directed lenders to deposit the interest directly into the borrower’s banks, you could reach out to your lender for greater clarity.

The writer is CEO, BankBazaar.com