The insurance industry is undergoing regulatory changes with the IRDAI bringing in reforms across categories in different areas of the business. The pace of reforms has picked up since former DFS secretary Debashish Panda took charge of IRDAI on March 14 and the impact of these changes on both policyholders as well as insurers is expected in the coming years.

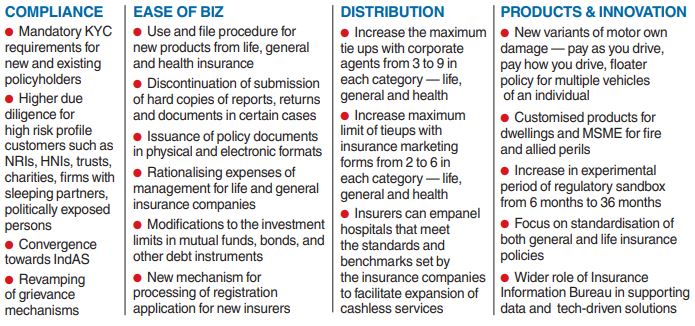

The changes, some of which are currently at the proposal stage (see chart), indicate the regulator’s intent to allow more insurance players to enter the market and more flexibility on product designing and innovation, to speed up approvals, widen distribution, reduce cost and compliance burden and also move towards more standardisation of policies.

The reforms are expected to streamline the operations of insurance companies and increase competition through more products, which in turn could lead to more choices for policyholders with market forces playing a wider role in determining the premium. But even after decades of opening up the industry, insurance penetration in the country continues to remain abysmally low indicating that insurance is still considered a push product and there is still a gap in the understanding of insurance among the wider section of the population.

India rank According to data compiled by global reinsurer Swiss Re, India ranked 10th among the top 20 insurance markets sorted by total premium volume. India’s global market share was only 1.9 per cent in 2021. While life insurance penetration (premium as per cent of GDP) was 3.2 per cent in 2021, non-life insurance was a mere 1 per cent and below the global average of 3.9 per cent. While the regulator has publicly stated its focus to address insurance penetration through reforms, insurance industry observers, who also expect a rise in demand as an outcome of the reforms, said buyers when faced with myriad choices, must not lose track of the fundamentals in the selection of both insurance policy and the distributor.

Multiple options “Of late, IRDAI has been taking several initiatives to bring in product innovations to facilitate the policyholder. Some critical ones are — allowing insurers to use and file products, usage based and behavior-based pricing. Such steps would propel product innovation and bring multiple options to the consumer. “However, given the plethora of choices, the consumer must be aware of some of the covers which are critical to indemnify the former in case of an unforeseen occurrence,” said Debashish Roy, head, PoS business, Anand Rathi Insurance Brokers.

“India has traditionally been a push market for insurance, but with the latest announcements by IRDAI, a huge impact is expected on boosting consumption of insurance. For policyholders, arriving at the right decision on a potential insurance purchase will get easier over time as understanding of insurance products will get simplified,” said Susheel Tejuja, MD, PolicBoss.com “Policyholders should bear in mind that not just the policy features and premiums, they should also factor in insurance company performance on the basis of claim servicing history. While opting for an insurance broker, it is crucial for the policyholder to observe the regulatory track record, reach and ability to service claims, presence across geographies,” said Tejuja.

Industry observers also said that policyholders should also have a clear understanding of marketing gimmicks. One example is the per-day cost basis quotes advertised by insurers — for instance, Rs 1 crore term policy at Rs 30 per day.

Premium is calculated on the basis of certain age groups and tenure and the advertised premium may not be the one applicable in the case of the buyer. Proper disclosures It is also crucial to make proper disclosures at the time of purchase of the policy and its importance is more so in the age of online policy purchase. For instance, in the case of health insurance, one of the worst things a policyholder can do is to hide the fact that they smoke or consume alcohol at the time of purchase/renewal.

These circumstances often lead to the rejection of claims. Another important aspect is to declare any pre-existing policies and its lack of disclosure can also lead to the rejection of claims. One of the outcomes of the current reforms would be the rise of riders and addons to base insurance policies as insurance companies innovate and add features to their current products. However, not every rider or addon is necessary and it often does not justify the expenses just for a sense of more security. It is important to understand the policy documents and the exclusions and clauses. A couple of examples that policyholders often tend to miss are waiting periods and co-payment clauses.

If the policyholder has declared pre-existing diseases, there could be a certain waiting period before coverage begins. Certain health policies may include co-payment clauses where the policyholder agrees to pay a part of the expenses from their own pocket. While these may lower the premium, it could pinch the policyholder at the time of claim settlement.