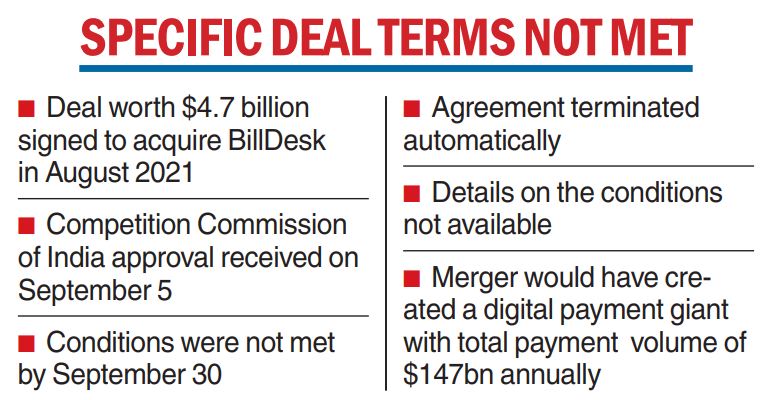

Prosus NV, the PayU parent, has terminated a $4.7 billion deal to acquire Indian payments firm BillDesk after conditions on the deal were not met.

The amalgamation of BillDesk with PayU would have created a digital payment giant with an annual total payment volume (TPV) of $147 billion. It was in August last year that Prosus had announced this biggest acquisition in India’s fintech space through an all-cash deal to expand its footprint in India’s fintech sector.

In a statement, Prosus said that certain conditions precedent were not met by the deadline at the end of September. The global consumer internet group did not specify which conditions were not met.

Incidentally, the transaction had received the approval of the Competition Commission of India (CCI) on September 5. It is learnt that there is no termination fee arising from the scrapping of the transaction.

A condition precedent is a stipulation that defines certain circumstances that must either occur or be met by either party to ensure progress or execution of a contract.

"Closing of the transaction was subject to the fulfillment of various conditions precedent, including approval by the CCI. PayU secured CCI approval on September 5, 2022. However, certain conditions precedent were not fulfilled by the September 30, 2022 long stop date, and the agreement has terminated automatically in accordance with its terms and, accordingly, the proposed transaction will not be implemented," Prosus said.

Prosus added that it has been a long-term investor and operator in India — investing close to $6 billion in Indian technology companies since 2005 and that it remains committed to the Indian market apart from growing its existing businesses within the region. Its other investments in India include Byju’s, Pharmeasy, Meesho and Swiggy.

Billdesk, the payment gateway was founded in 2000 by three consultants from Arthur Andersen LLP — MN Srinivasu, Ajay Kaushal and Karthik Ganapathy out of an apartment in Bandra, Mumbai. Following the massive rise in digital payments over the past few years It counts private equity firm General Atlantic as its single-largest shareholder with a holding of about 14.2 per cent.

TA Associates held a 13.1 per cent stake while Visa had 12.6 per cent in the firm. The three founders had close to 30 per cent shareholding. It provides solutions ranging from settlements, collections, reconciliations, and auto settlements.

It also partners with companies in categories such as billing, utility payments, direct-to-consumer procurement, government payments, and financial services.

As per Tracxn, Billdesk was valued at $1.59 billion following a January 2019 funding round. The founders of Billdesk had earlier said during the BillDesk and PayU combid will support the rapid growth of digital financial services and focus on innovating to enable its clients to serve their customers better.

PhonePe shifts base

Walmart-owned PhonePe has concluded the process of moving its domicile from Singapore to India.

The move comes ahead of the company’s speculative plans of making an initial public offer in India.

The digital payments and financial services provider completed the process in three steps.

Flipkart had partially spun-off PhonePe in December 2020 to enable the payments firm to access dedicated capital to fund its long-term ambitions over the next three to four years.

The e-commerce firm continues to be its biggest shareholder.

As per the last fundraise of $700 million, about Rs 5,172 crore, PhonePe was valued at $ 5.5 billion.