Shares of One97Communications Ltd, the parent of Paytm, leapt more than7 per cent after the company said its board would meet on Monday to consider a share buyback.

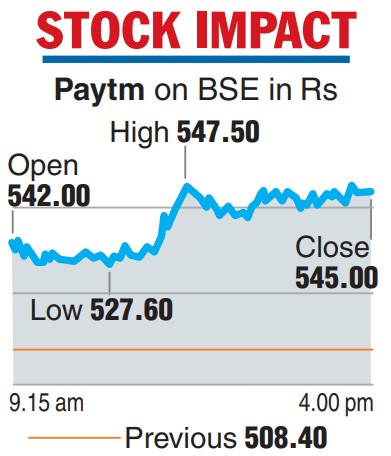

The Paytm scrip on Friday ended at Rs 545 — a gain of Rs36.60, or 7.20 per cent, on the BSE. Almost 16.79 lakh shares were traded on the bourse against the two-week average of 6.68 lakh shares. Duringintra-day trades, the scrip hit a high of Rs 547.50 — a rise of nearly 7.70 per cent. On the NSE, the counter settled 7.19per cent higher at Rs 544.75.

The stock has lost 76 percent of its value from its issue price of Rs 2,150 per share amid concerns over its path to profitability.

The buyback follows moves by some of the other start-ups such as Nykaa, which came up with a 5:1 bonus share issue.

“The management believes that given the company’s prevailing liquidity/ financial position, a buyback may be beneficial for our shareholders,” the filing said.

The company has told analysts that it expects to become cash flow positive in the next 12-18 months.

Under a share buyback or repurchase, a company buys back its own shares either from the open market or through the tender offer route from investors.

Buyback is seen as an alternative, tax-efficient way to return money to shareholders. Companies come up with such a buyback to return surplus cash to shareholders or to support their share prices.

Paytm, which has around Rs 9,182 crore of cash in hand as of September 30, 2022, has been posting losses.

The company’s consolidated losses had widened to Rs571.5 crore in the second quarter ended September, 30, 2022from Rs 473.5 crore in a year ago period.

The company said that it will achieve EBITDA breakeven by September 2023.