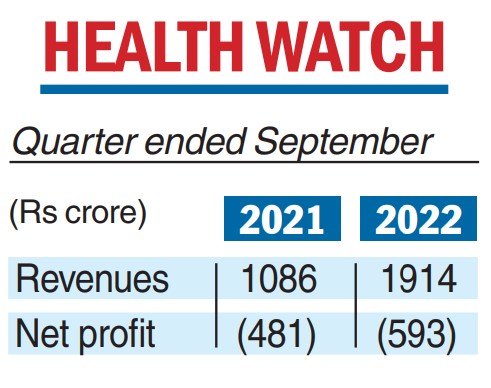

Digital financial services firm One97 Communications, which owns the Paytm brand, on Monday reported a widening of consolidated loss to Rs 593.9 crore in the second quarter ended September 30.

The company had posted a loss of Rs 481 crore in the same period a year ago, Paytm said in its regulatory filing.

Paytm’s consolidated revenue from operations increased by about 76 per cent to Rs 1,914 crore from Rs 1,086.4 crore in the September 2021 quarter.

Paytm said revenue from payment services to consumers increased 55 per cent to Rs 549 crore on a year-on-year (YoY) basis, while payment services to merchants went up 56 per cent to Rs 624 crore.

“This was achieved without any UPI incentive during the quarter,” the company said.

The company’s net payment margin (calculated as payments revenues plus other operating revenues, less payment processing cost) increased multi-fold to Rs 443 crore on year-on-year basis on account of improved monetisation and continued focus on reduction in payment processing charges.

The company’s revenue from the financial services business was up 293 per cent to Rs 349 crore on a Y-o-Y basis and now accounts for 18 percent of total revenue, compared with 8 per cent in the September 2021 quarter.

“In the second quarter ofFY2023, Paytm disbursed 9.2million loans, up 224 per centY-o-Y amounting to Rs 7,313crore,” the company said.

The average monthly transacting users (MTU) grew39 per cent Y-o-Y to 7.97 crore while the merchant base has increased to 2.95 crore, the company said.