Paytm may turn operationally profitable by March 2023, six months ahead of the company’s own guidance, Goldman Sachs has forecast.

The investment bank raised the target price for the stock to Rs 1,120 from Rs 1,100 previously, an upside of over 100 per cent from its current market price.

In a note released Tuesday, Goldman maintained its buy rating on One97 Communications, the parent of Paytm.

The company’s lending business for the current fiscal is tracking 90 per cent higher than Goldman’s estimate made in December 2021. Besides, strong payment margins have resulted in the company’s profitability continuing to surprise on the upside.

Paytm is part of Goldman Sachs’ Asia (excluding Japan) “Conviction List”, which contains select buy-rated stocks based on the size and likelihood of the realisation of their returns.

The projection, however, did not move the Paytm stock up on Tuesday: it ended with losses of 4.78 per cent or Rs 26.45 at Rs 526.65 on the BSE.

Since its listing in November 2021, Paytm has continued to trade much below the issue price of Rs 2,150 per share with questions being raised on when it would turn profitable.

While the company is currently in the midst of a buyback programme, positive developments such as a strong loan disbursal have prevented a major downside.

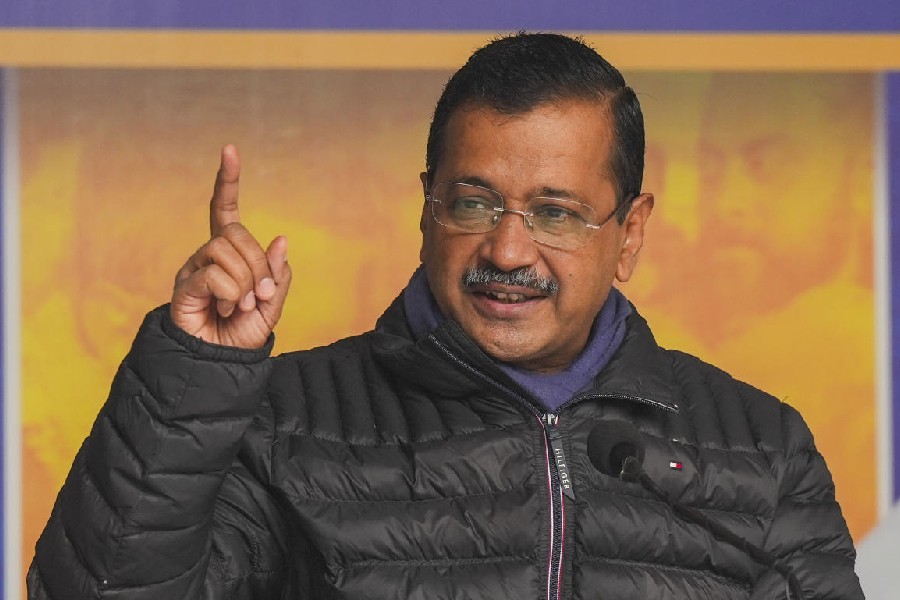

Founder Vijay Shekhar Sharma has reiterated Paytm is on track to achieve the target of EBITDA profitability by September 2023 because of strong growth in payments and a jump in the lending business.

Paytm provides loans to customers and merchants in tie-ups with non-banking finance companies, for which it earns a commission.

The analysts at Goldman Sachs added that Paytm reported Gross Merchant Value (GMV) of Rs 3.4 lakh crore in the third quarter, which accounts for 24 per cent of India’s digital payments.

The sequential GMV growth at 9 per cent was weaker than a year ago because of the early onset of the festive season in 2022.

Loan disbursals saw 36 per cent sequential growth in the third quarter.