One 97 Communications Ltd, the operator of India’s largest digital paymentsprovider Paytm, cannot useproceeds of its mega initialpublic offering (IPO) for theproposed repurchase of itsown shares, as rules prohibitsuch a move, sources said, adding the firm will use its strongliquidity for the purpose.

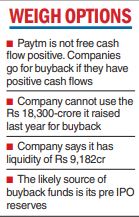

Paytm has a liquidity of Rs9,182 crore, as per its last earnings report.

The company’s board isscheduled to meet on December 13 to consider a sharebuyback proposal. “The management believes that giventhe company’s prevailingliquidity/ financial position,a buyback may be beneficialfor our shareholders,” it hadstated in an exchange filing onThursday.

After a much-watched listing late last year, the stock is down 60 per cent in 2022 amid a global tech selloff and questions swirl around the firm’s profitability, competition and costs related to marketing and employee stock options.

Sources said regulations prevent any company from using IPO proceeds for a share buyback.

Paytm had in November last year raised Rs 18,300 crore through the IPO.

While the company had last month said it would become free cash flow positive in the next 12-18 months, sources indicated the firm is close to cash flow generation, which will be used for business expansion.

Amid a buzz that the company is using IPO funds for the buyback, sources said regulations bar any company from doing so. The proceeds from the IPO can only be used for the specific purpose it is raised for and that too is monitored.

In a meeting with analysts, the Paytm management highlighted that the company is close to cash flow generation, which future will be used for expansion.