The Telegraph

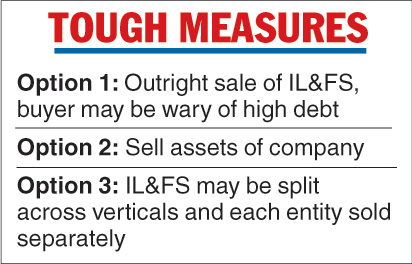

An outright sale of IL&FS could be one of the options that could be explored by the government-appointed board to pull the infrastructure financier out of its liquidity crisis.

The board may also examine the possibility of selling some of its assets or splitting the business into different verticals and divesting them.

Earlier this month, the Centre had superseded the board of IL&FS as it sought to control any adverse effect on the country’s credit market following several defaults by the conglomerate.

The government had moved the Mumbai bench of the National Company Law Tribunal (NCLT) to suspend the then seven-member board and appoint a new one to manage the affairs of the company and its subsidiaries.

The two-member NCLT bench had accepted the interim prayer of suspending the board and its reconstitution. It had also said that the new board should prepare a road map for the revival of IL&FS, “at the earliest possible, not later than the next date of hearing’’. The matter will be heard on Wednesday.

While IL&FS officials did not comment on the proposals that could be submitted by the board, led by senior banker Uday Kotak, to the tribunal on Wednesday, the buzz is that one plan could be the outright sale of IL&FS to a financially strong investor.

However, given the mammoth debt of Rs 91,000 crore at IL&FS, it is not clear as to whether such a plan will be successful. Another option could be the sale of various assets (both core and non-core), which would enable the group to meet its liquidity requirements and prevent fresh defaults.

The reconstituted board of IL&FS had met for the first time on October 4, and Kotak had indicated that they were examining multiple options.

He had said there were 348 entities within the conglomerate and this was significantly larger than what they had

anticipated. The banking sector’s exposure to IL&FS stands at nearly Rs 53,000 crore.

Recently, the IL&FS board appointed Arpwood Capital Pvt Ltd and JM Financial Consultants Pvt Ltd as financial and transaction advisors (FTAs) to the group.

As part of their engagement, the FTAs will be advising the board on solutions towards resolution for the conglomerate.