The Telegraph

Oil industry officials said the shift from fixed to ad valorem rates had turned things from bad to worse.

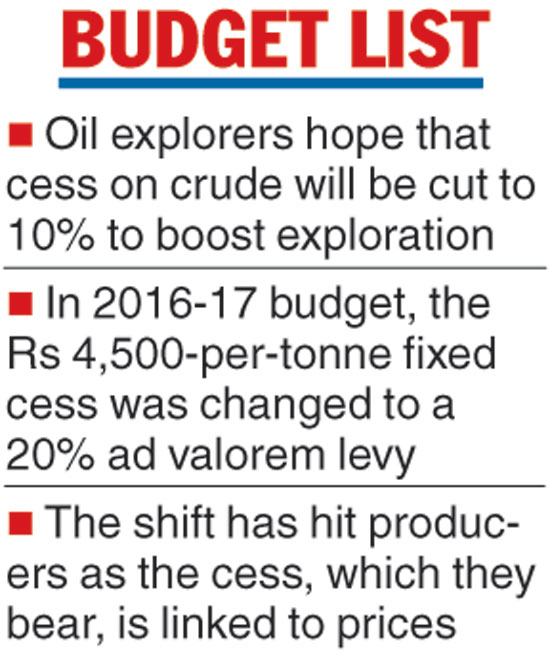

Under the ad valorem rate, the duty is linked to prices, meaning when prices rise tax collections are higher and they fall when prices are lower. Cess is a production tax, which is not a pass-through, and, so, has to be borne by the oil producers.

The open acreage licensing policy (OALP) with pricing and marketing freedoms along with the power to select the block for exploration does not attract oil cess.

It places domestic oil production vis-a-vis imported crude at a significant disadvantage as imported crude does not attract such a duty and the levy is against the spirit of “Make in India,” they said.

The oil minister had recently said that the government was working on giving “incentives to the exploration and production sector, especially those under the nomination regime and special incentives to difficult fields under that regime”.

The oil exploration sector could hope for some relief in the interim budget for 2019-20 with the government planning to cut the cess on crude to encourage exploration activity and reduce the country’s energy import bill.

The oil cess has been one of the concerns of the exploration firms in the country and has been taken up with the finance ministry, said oil ministry officials.

They are optimistic that some positive decision could be taken in the budget as it will help improve the investment climate.

The government could cut the oil cess to 10 per cent to boost exploration, industry officials said. In the 2016-17 budget, finance minister Arun Jaitley had converted the Rs 4,500-per-tonne fixed cess on crude to a 20 per cent ad valorem levy.