The Telegraph

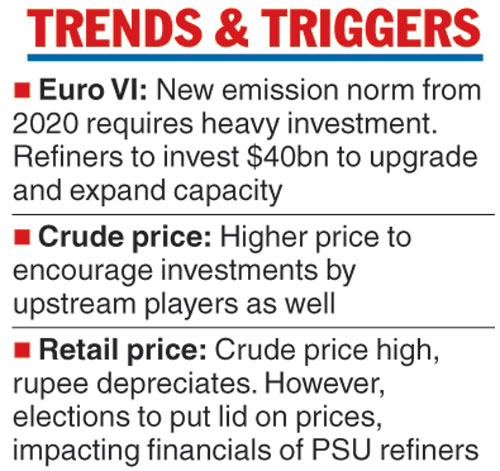

Fitch said it expects “upstream investments to also remain high, given the strong crude prices and the need to arrest the falling domestic production and reserves”.

According to the rating agency, the government’s move to lower retail prices may hit the profitability of IOC, BPCL and HPCL in 2018-19 before being reversed in the next fiscal. The credit metrics of the three companies are likely to weaken moderately in 2019 as a result of lower retail and refining margins and large ongoing capex.

Further, it expects the credit metrics of Reliance Industries to improve in the near to medium term, benefiting from its investment in petrochemical refining operations.

Pressure on margins

The fuel price cut highlights the regulatory risks of oil marketing companies as a result of rising crude oil prices and the weakening rupee, especially with the upcoming elections in 2019 and continuing margin pressure through 2019-20, the report said.

“We expect under-recoveries to rise steeply in 2018-19, driven by high crude prices. The state continues to shoulder the full share of under-recoveries. However, we expect pressure on upstream firms for higher payouts to reduce the benefits from high crude prices,” the agency said.

Oil marketing companies are likely to invest about $40 billion over the next five years to meet the new Euro-VI emission standards by 2020.

“The capex plans for downstream companies will be driven by capacity expansion and refinery upgradation to meet the new emission standards in 2020. The three oil marketing companies (OMCs) together with HPCL-Mittal Energy are likely to invest about $35-$40 billion over the next five years,” US-based Fitch Ratings said in a report.

IOC plans to double its refining capacity to 150 million tonnes per annum (mtpa) by 2030 from 80.7 million tonnes by expanding the refineries of subsidiary Chennai Petroleum Corp and the proposed Ratnagiri Refinery & Petrochemicals Ltd, among others.

BPCL plans to upgrade its Mumbai refinery to 14mtpa from 12mtpa. It is also looking to expand the capacity of its Assam-based Numaligarh refinery to 9mtpa from 3mtpa.

HPCL plans to ramp up the Vizag complex to 15mtpa from 8.3mtpa, while the Mumbai refinery’s capacity will be increased to 9.5mtpa from 7.5mtpa. Moreover, a 9mt integrated refinery and petroleum complex will come up at Barmer in Rajasthan.