The government expects state-run banks to gain about Rs 2 lakh crore this year through the recovery of bad loans and sales of non-core assets.

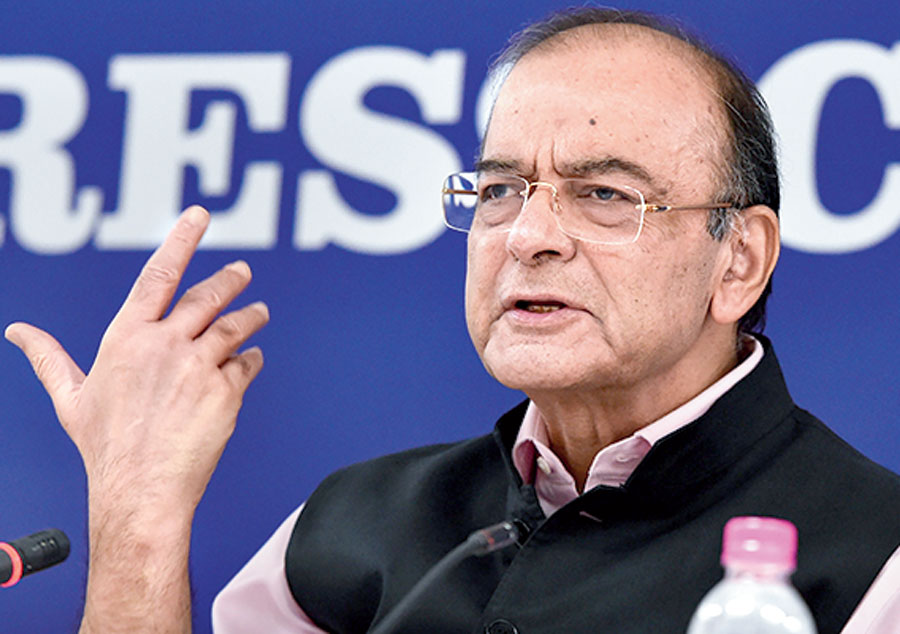

The proceedings of the annual review of state-run banks by finance minister Arun Jaitley on Tuesday highlighted the possible recovery of Rs 1.8 lakh crore in bad loans through resolution mechanisms as well as from the insolvency and bankruptcy code cases of some large borrowers with huge accumulated bad loans.

“We find NPAs are coming down… debtors are paying up because they may have to face IBC proceedings otherwise,” Jaitley said.

He said lenders also expect to earn close to Rs 18,000 crore in this financial year from non-core divestments. Officials said plans were also in place for banks to sell their overseas subsidiaries and housing finance arms.

The government had asked all banks to identify non-core assets which could be earmarked for monetisation as well as rationalise overseas operation. So far, banks have collectively decided to shut down 41 overseas branches.

The government also asked bankers to “complete action by December 2018 on fraud detection and initiation of action in respect of NPAs with outstanding of above Rs 50 crore”.

Top finance ministry officials said bankers sought relaxations in the Prompt Corrective Action norms, which were holding up their ability to give fresh loans and earn the revenues needed to pare their bad loans ratio, which in the first place landed them in the PCA list.

Bankers also want the government to speed up recapitalisation as lack of capital adequacy is hampering their attempts to meet government targets on lending to key sectors such as small and medium businesses.

Officials said the government has decided to infuse Rs 2,350 crore into Central Bank of India to meet its capital requirements. With this, the government will inject around Rs 13,600 crore into public sector banks this financial year.

Bankers complain the pace of capital infusion has been extremelty slow, placing them in problems even as the government makes demands that they take steps to revive lending.