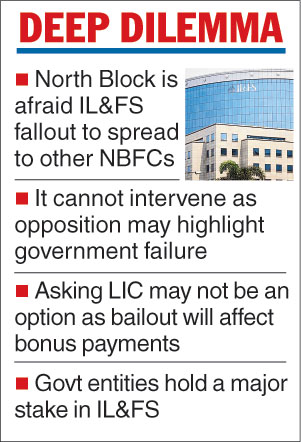

The finance ministry is deeply worried by the IL&FS fiasco — as many on the Street see it as India’s Lehman Brothers moment — but would still like to play a hands-off resolution game because it could otherwise turn into a political hot potato.

Top North Block officials said they were not averse to either a sale to foreign investors or a bailout by the existing shareholders.

“We would encourage a sale if the terms are good and creditors are comfortable with it. Alternatively, promoters could find a way out either on their own or by meeting with sector regulators.”

The Street, currently in a bear hug over IL&FS, is rife with rumours about Japan’s Orix, which is the second largest investor in the company, and Abu Dhabi Investment Authority which owns some 12.56 per cent stake, could buy new shares and take over the troubled infrastructure lending company.

Though it is a private company, IL&FS has many state-owned entities as its principal owners.

The LIC owns the largest chunk of shares at 25.34 per cent, Central Bank has 7.67 per cent equity and the SBI another 6.42 per cent, taking the indirect government stake to nearly 40 per cent.

The presence of state-owned entities allowed IL&FS to get near sovereign rating even though it’s balance sheet was a mess and the RBI in two inspection reports had noted that its net owned fund had turned negative.

However, since its troubles became public, rating agencies have junked the various debt papers of IL&FS and its subsidiaries.

The PSU holding also made the company susceptible to government nudges, though the government was not really responsible for its failings. However, any attempt by the government now to directly save the company could be highlighted by the Opposition, which has already demanded a probe into the company.

On the basis of triple A credit ratings, IL&FS managed to pile up some Rs 91,000 crore in debt, despite its balance sheet problems. The subsidiaries, too, have reported losses in their investments in highways, metro, power and other infrastructure projects.

“It’s (IL&FS) not a bubble case, it is a liquidity problem case. The assets invested in are real assets, these are not toxic or non existing assets, so we do believe that if the liquidity issue is sorted out, the financial firm IL&FS will sort out its problems,” said North Block’s financial services division officials.

However, the problem with their favourite solution — pumping in of funds by existing stake holders, including the LIC which seems to have been endorsed by the RBI, too, — is the fear that the LIC is being bled by the government to sort out its financial problems that have cropped up elsewhere, thus risking the money of millions of people who have invested in the insurer.

Attempts to use policy-holder’s money to bail out IDBI, IL&FS and others may boomerang and puncture LIC’s bonus plans because of the losses suffered on from such rescue missions.

In some ways, the North Block mandarins are haunted by the memories of the UTI fiasco — some 285 companies in which the UTI invested simply disappeared. More than Rs 6,000 crore invested by UTI in PSU shares took a beating as the share market value nearly halved.

Officials point out that since the LIC has nearly Rs 28 lakh crore as assets under management, even a total write-off of its investment in IDBI of Rs 13,000 crore or even double that amount would be less than 1 per cent of its total funds.

Nevertheless, losses in some of the LIC’s investments once in a while do not affect balance sheet, as most of the LIC investments are in gilt debt which are considered totally safe. However, the problem lies in bonuses which the LIC pays out — if it starts losing money on investments, it pays lower bonuses.

RBI meet

The Reserve Bank will meet the large shareholders of ILFS on Friday to discuss a turnaround plan for the crisis-ridden infra major, the central bank sources said, according to PTI.

Telegraph picture