Microfinance self-regulatory organisation — Sa-Dhan — has introduced a credit assessment framework (CAF) to evaluate borrowers .

The framework comes at a time issues relating to over-indebtedness, particularly in a few states, have elevated the risk profile of the sector.

In Assam for instance, it was observed that the overall indebtedness cap of Rs 1.25 lakh was not effective especially in case of wage-earning tea garden workers.

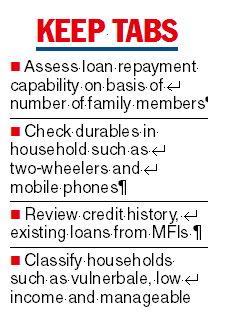

The framework allows income and expenditure assessment of borrowers on parameters such as the number of earning members and regularity of cash flows.

The framework also includes well-being parameters such as roof material of house, access to gas cylinder and electricity, having a two-wheeler and smartphone, which can be tailored for different locations.

These are in addition to the credit history and indebtedness assessment, which looks at the number of MFIs where the borrower has outstanding loans, monthly repayment outgo, instances of late payment and NPA, adherence to group norms among others.

Based on the parameters, households are categorised as vulnerable, low income and manageable and coupled with district economic potential can be used for determining maximum repayment outgo.

“CAF will not only promote client protection but also help MFIs in determining loan sizes based on risk profiling thereby increasing repayment rates and reducing risk,” said P. Satish, executive director Sa-Dhan.

“Things are not often done in a scientific manner and one size fits all does not work in microfinance,” said Somesh Dayal, deputy director, Sa-Dhan.

“This framework can become an industry standard and can be applicable for all lenders not just the NBFC MFIs but anyone engaged in microfinance including banks SFBs, NBFCs to get a more accurate assessment of the clients,” he added.

In a recent consultative document, the RBI has proposed to cap the payment of interest and repayment of principal for all outstanding loans of the household at any point to 50 per cent of the household income.