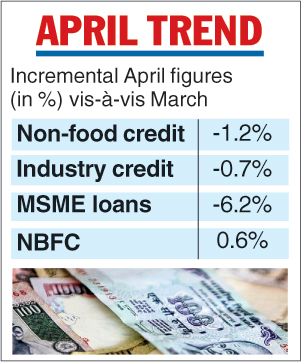

The outstanding incremental non-food credit growth contracted 1.2 per cent to Rs 91 lakh crore in April from Rs 92.12 lakh crore in March, according to latest Reserve Bank data.

On a year-on-year basis, non-food credit growth decelerated 7.3 per cent in April from 11.9 per cent in the same month last year, the data showed.

Incremental bank loans to industries (micro, small, medium and large industries) contracted 0.7 per cent to Rs 28.84 lakh crore in the reporting month against Rs 29.05 lakh crore in the previous month.

Loans to micro and small industries de-grew by negative (-) 6.2 per cent to Rs 3.58 lakh crore from Rs 3.81 lakh crore in March 2020.

Advances to NBFCs grew 0.6 per cent to Rs 8.12 lakh crore from Rs 8.07 lakh crore in March 2020, the RBI release on Sectoral Deployment of Bank Credit — April 2020, showed. On a year-on-year basis, growth in advances to NBFCs declined 30.3 per cent against a growth of 37.8 per cent last year.

Growth in bank loans to the commercial real estate sector rose 14.8 per cent from 8.3 per cent in April 2019.

Loan growth to agriculture & allied activities decelerated to 3.9 per cent in April 2020 from 7.9 per cent in April 2019.

Growth in advances to the services sector decelerated 11.2 per cent from 16.8 per cent in April 2019.

Personal loans growth decelerated to 12.1 per cent in April 2020 from 15.7 per cent in April 2019.

In a separate release, RBI said bank credit growth for March 2020 recorded moderation across all population groups — rural, semi-urban, urban, metropolitan.

“Metropolitan branches, which account for nearly 63 per cent of credit, recorded deceleration in credit growth to 4.8 per cent year-on-year in March 2020 from 13.5 per cent a year ago,” RBI said in its release on Quarterly Statistics on Deposits and Credit of SCBs for March 2020.

Citi fined

The Reserve Bank has imposed a penalty of Rs 4 crore on Citibank for non-compliance with various regulatory norms and directions of the central bank.

In a release, the RBI said the penalty has been imposed on Citibank N.A. for contravention of certain sections of the Banking Regulation Act and for non-compliance with directions.