Non-bank microfinance companies (NBFCMFIs) have surpassed banks in terms of micro credit market share having clocked a 43.37 per cent growth in portfolio and a 32.06 per cent growth in disbursements at the end of December 2022.

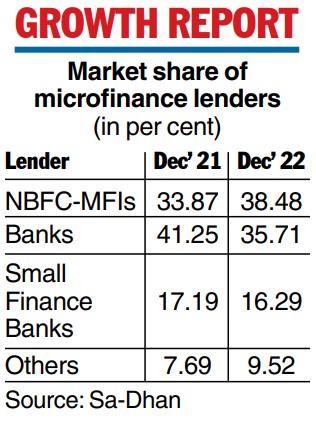

The assets under management of NBFC-MFIs stood atRs 1,24,689 crore as on December 2022 with a market share of 38.48 per cent, while banks had assets under management of Rs 1,15,698 crore with a market share of 35.71 per cent.

In December 2021, banks had a market share of 41.25 per cent while NBFC-MFIs had a share of 33.87 per cent, according to data compiled by Sa-Dhan, a self-regulatory organisation for microfinance institutions.

The average ticket size of NBFC-MFIs stood at Rs 41,245 as of December 2022, up from 36,141 on December 2021. For banks, the average ticket size was Rs 38,457 as on December 2022 down from Rs 40,696 as on December 2021.

The combined microcredit portfolio of all lenders as of December 31, 2022, was Rs 3,24,017 crore.

The portfolio at risk (30 days past due) improved to 3.43 per cent during the third quarter of FY23 from 8.77 per cent in the corresponding period of the previous year. However, Bengal, Delhi, Puducherry, Uttarakhand, Punjab, Chattisgarh, Madhya Pradesh, and Rajasthan continues to have PAR30+dpd higher than the industry average of 3.43 per cent.

“Q3 of the current fiscal has shown a robust growth of microcredit riding on the back of festivities and a resurgent economy. Compared to Q2, the portfolio of all lenders has grown by another Rs 20,000 crore. The continuing growth with healthyPAR reflects positively on the sector, though some states have higher than industry averagePAR30+ dpd,” said Jiji Mammen, ED and CEO, Sa-Dhan.

Bihar, Tamil Nadu, Uttar Pradesh, Karnataka, and Bengal account for 56 per cent of the total disbursements.