The RBI has made more individuals eligible for micro-finance loans, while removing the cap on interest rates on such loans.

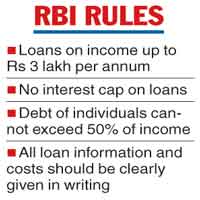

In its regulatory framework for the microfinance sector, the RBI said the annual household income level will be Rs 3 lakh to get a loan against the previous limit of Rs 1.25 lakh income for rural households and Rs 2 lakh for semi-urban and urban households

Besides, the monthly loan obligations of a household as a percentage of its income should be a maximum 50 per cent. A household comprises an individual family unit — husband, wife and their unmarried children.

The outflows should include repayments — both the principal as well as the interest component — towards all existing loans as well as the loans under consideration.

If existing loans exceed 50 per cent, they will have to mature. No new loans shall be given till the obligation level reaches 50 per cent.

The RBI also removed pricing caps on the microfinance loans. Previously, there were limits set on the maximum interest rate that a microfinance lender could charge on loans .

However, the RBI said that the lenders cannot charge usurious rate of interest. “Interest rates and other charges/fees on microfinance loans should not be usurious. These shall be subject to supervisory scrutiny by RBI,” the framework said.

The lender will have to disclose pricing-related information to a prospective borrower in a standardised simplified factsheet.

The regulations also said that there should be no pre-payment penalty on the loans.

“The latest guidelines are a strong reflection of the maturity that the microcredit industry has reached in India. It will help harmonise the regulatory framework for different types of lenders, encourage healthy competition and enable customers to make an informed choice,” Chandra Shekhar Ghosh, MD and CEO, Bandhan Bank said.

“Besides creating a level playing field, the framework will address issues of over indebtedness and multiple lending which were of paramount concerns for the sector,” said Alok Misra, CEO of MicroFinance Institutions Network.

“Revision in the household income will allow MFIs to cater to more needy borrowers,” said Kuldip Maity, managing directors and chief executive officer of Village Financial Services.