When Nirmala Sitharaman launched the new tax filing regime devoid of the benefit of any exemptions in 2020, she had hoped that it would catch fire.

It clearly didn’t.

That is why the finance minister has now taken several measures to make the scheme attractive: she has raised the tax rebate under section 115BAC to Rs 7 lakh which means people with an annual income up to that level will pay no tax.

This has been underpinned by a new proviso to section 87A to provide a tax rebate of Rs 25,000 (instead of Rs 12,500) for the assessment year 2024-25 in case one opts for the alternative tax regime.

Second, she has extended the standard deduction of Rs 50,000 to the new tax regime.

Finally, she has said the new tax regime will be the default option for taxpayers.

They can still opt for the existing regime under which Section 80 exemptions can be claimed.

Despite all her expostulations to the contrary, it is pretty apparent that the Narendra Modi regime intends to nudge the taxpayer to the exemption-free tax regime.

Ironically, this was exactly what P. Chidambaram wanted to introduce when he was finance minister in the UPA regime.

In 2009, he drafted a simplified direct tax code that sought to remove a concertina of tax breaks that filers have taken advantage of to reduce their tax liability but this was scuttled because of politics and oneupmanship within the party.

As of now, those Individuals and Hindu Undivided Families (HUF) with income up to Rs 5 lakh are not required to pay any income tax under either the old regime or the new one.

If the total income exceeds the specified monetary limit of Rs 5 lakh or Rs 7 lakh, as the case may be, the benefit of rebate under section 87A is not available. In such a case, the exemption limit will be restricted to Rs 3 lakh for the assessment year 2024-25.

Tax example

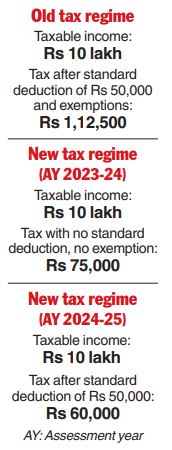

Consider an example where the taxable income of an individual is Rs 10 lakh. Under the new tax regime, the tax liability now is Rs 60,000 for the assessment year 2024-25. It was Rs 75,000 for the assessment year 2023-24 and, thus, the taxpayer now gets a benefit of Rs 15,000.

Standard deduction can be claimed under Section 16(i) in both the old and new regimes by salaried employees, which was not available for the assessment year 2023-24 in the case of the new regime.

In her budget speech, the finance minister said: “For the salaried class and the pensioners including family pensioners for whom I propose to extend the benefit of standard deduction to the taxpayers in the new tax regime. Each salaried person with an income of Rs 15.5 Lakh or more will thus stand to benefit by Rs 52,500.”

Section 16(i) allows standard deduction of Rs 50,000. This will remain Rs 50,000 as no amendment appears to have been proposed. Sitharaman has also proposed to allow the benefit of deduction under Section 57(iia) from family pension in the case of both old and new regimes.

The tax rebate for those paying tax under the normal system shall be limited to Rs 12,500 — that too if total income is within Rs 5 lakh. It may be noted that if the total income exceeds the monetary limit of Rs 5 lakh, then the benefit of the rebate is not available.

However, deduction contribution to specified Pension Fund under Section 80CCD(2), contribution to Agniveer Corpus Fund under Section 80CCH(2) or for cost of employment to new employees under Section 80JJAA can be claimed.

A person having income from business can exercise the option to pay tax under section 115BAC, and can opt for the old system only once.

However, in other cases, a taxpayer is at liberty to opt for a new alternative tax regime or revert to the old tax system from year to year.

Leave encashment

The limit for tax exemption for leave encashment was Rs 3 lakh on the retirement of non-government salaried employees, which was fixed in the year 2022. The finance minister has proposed to increase the limit to Rs 25 lakh under Section 10(10AA)(ii) to bring it on a par with that for government employees.

Presumptive tax

The assessee having income from a business is eligible to opt for presumptive tax under Section 44AD if the gross receipts or total turnover does not exceed Rs 2 crore. This limit is proposed to be increased to Rs 3 crore in case the amount received in cash does not exceed 5 per cent of aggregate receipts or total turnover.

Likewise, the assessee having income from profession is currently eligible to opt for presumptive tax under Section 44ADA if the total gross receipts from profession referred to in Section 44AA(1) does not exceed Rs 50 lakh. This limit is proposed to be increased to Rs 75 lakh in case the amount received in cash does not exceed 5 per cent of total gross receipts.

Surcharge

The finance minister has proposed to raise the maximum rate of surcharge to 25 per cent instead of 37 per cent, as was applicable in case of total income exceeding Rs 5 crore. The maximum tax burden on taxpayers having income more than Rs 5 crore was 42.74 per cent which will stand reduced to 39 per cent from the assessment year 2024-25 in both the old as well as new tax regimes.

The government has proposed a total of 122 amendments to income tax alone.

(Narayan Jain is a tax advocate and national deputy president of the All India Federation of Tax Practitioners. The views expressed are personal).