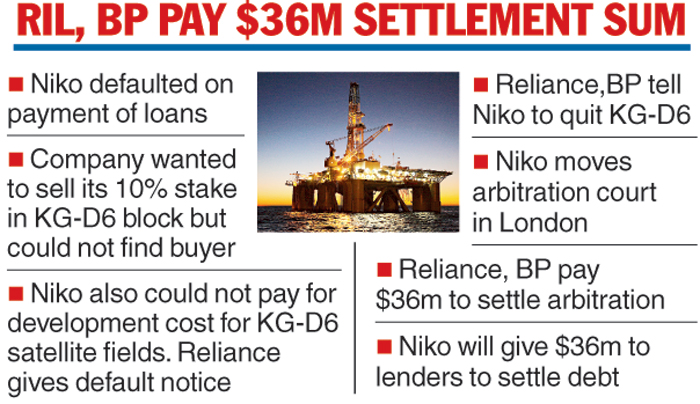

Reliance Industries and the UK’s BP Plc have paid $36 million to their Canadian partner Niko Resources for the latter to exit the eastern offshore KG-D6 block.

Niko, in a statement posted on its website, said it has exited the KG-DWN-98/3 block and its 10 per cent stake has been taken over by Reliance and BP. The company was paid $36 million to settle an arbitration it had initiated against Reliance and BP for trying to force it out of the block over a default in payment.

Niko said the net proceeds from the transaction would be distributed solely among its lenders.

“An amendment to the production sharing contract for the KG-D6 block in India has been executed, reflecting the assignment of the 10 per cent interest held by the company’s indirect subsidiary, Niko (NECO) Ltd to the remaining interest holders in the block, Reliance Industries and BP Exploration (Alpha) Ltd (BPEAL),” the statement said.

After Niko’s exit, Reliance’s stake in KG-D6 will go up to 66.67 per cent from 60 per cent and that of BP to 33.33 per cent from 30 per cent.

The Telegraph

“Niko had entered into a settlement agreement with Reliance and BPEAL under which it agreed to withdraw from KG-D6 and settle its arbitration case filed under the rules of the London Court of International Arbitration in December 2017 in exchange for a settlement amount of $36 million,” it said.

The settlement agreement is subject to certain conditions, including amendment to the KG-D6 production sharing contract (PSC), it said.

Arbitration trigger

Niko, which defaulted on the payment of loans to its lenders, had been unsuccessful in seeking a possible buyer for its 10 per cent stake in the Bay of Bengal KG-D6 block or securing financing for its share of the $5-billion R-cluster, satellite cluster and MJ development projects in the block.

This led to the company defaulting on payments for its share of the development cost. Reliance, being the operator of the KG-D6 block, slapped a default notice on Niko.

Under the terms of the joint operating agreement among the participating interest holders in the KG-D6 PSC, during the continuance of a default, the defaulting party shall not have a right to its share of revenue. The share shall vest in and be the property of the non-defaulting parties who have paid to cover the amount in default).

In addition, if the defaulting party does not cure a default within 60 days of the notice, the non-defaulting parties have the option to require the defaulting party to withdraw from the joint agreement.

In December 2018, Reliance and BP sent Niko a notice asking it to withdraw from KG-D6. Parallelly, they approached the sector regulator, the directorate-general of hydrocarbons (DGH), and the oil ministry for their approval to take over Niko’s share.

Niko filed a notice of arbitration challenging the withdrawal notice as it sought to stall the takeover.

Niko had previously withdrawn from the eastern offshore NEC-25 block because of cash crunch.