Companies will have to wrestle with a new compliance requirement from July 1 as a new levy — TDS on purchase of goods — has kicked in from July 1. Taxes deducted at source (TDS) and taxes collected at source (TCS) have not only proved to be an important source of revenue generation for the government but have also been a rich source of data on the direct tax front.

With the new levy of TDS on purchase of goods, the government seems to have shown immense confidence in the IT infrastructure and data analytics capabilities of the revenue department.

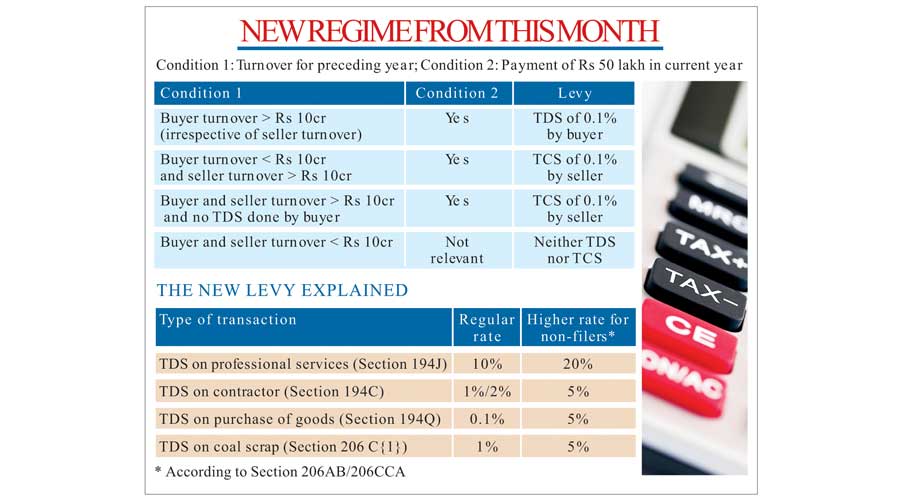

Buyers will now have to deduct tax at 0.1 per cent on the purchase consideration exceeding Rs 50 lakh made from one party in a financial year and report such data to the tax authorities.

The data may be used by the government for further reconciliation with similar data furnished by taxpayers under other legislations.

There has been an increasing trend in enquiries for such reconciliations after tax assessments went “faceless” last year. This has left businesses with no choice but to toe the line of the government and invest in expanding their digital/IT capabilities to manage large quantities of data and ensure consistency.

Effective from July 1, certain new TDS/TCS provisions are applicable along with the existing compliances on TDS/ TCS. These provisions cast an obligation on businessmen to deduct or collect taxes at twice the existing rate or 5 per cent, whichever is higher, on transactions with taxpayers who have not filed their income-tax return for the last two assessment years.

This amendment is also focused on generating more data for the tax authorities and aims to augment the number of taxpayers filing their income-tax returns.

With no mechanism to ascertain such details and rising apprehensions in the minds of taxpayers, the revenue department has recently launched a “Compliance Check Facility” which the taxpayers can use to identify parties on whom the higher rate shall apply using PAN.

Few clarifications have also been issued by the CBDT on June 30 in respect of the new TDS levy on the purchase of goods applicable from July 1.

Every new amendment brings its own share of interpretational issues and practical challenges, but it’s only a matter of time, before India Inc finds ease in compliance with such tedious TDS provisions, with due support from the CBDT and the IT infrastructure.

While major IT changes were made to capture and comply with the new TCS levy on the sale of goods last year, the recent TDS levy would necessitate a complete revamp of IT systems to handle the interplay between TDS and TCS (where new TDS provisions may prevail over TCS on the sale of goods and such TCS shall coexist, to be levied subject to thresholds) and for timely compliances.

While the government’s “Compliance Check Facility” has provided a window for verification on return filing status, it is equally important for businesses to determine whether a transaction would be liable to TDS or TCS levy separately.

Initially, this major amendment may pose a few challenges but in times to come, will only result in ease of compliance once the IT systems of the company are well aligned with the tax laws.

Dinesh Agarwal is tax partner and Chetan Mehta is tax director at EY India