The central board of the Reserve Bank of India (RBI) under new governor Shaktikanta Das will meet on Friday where the directors are likely to push for greater say in the decision-making of the central bank.

The meeting will review the progress of some of the decisions taken at the last meeting on November 19. Among other things, the crucial board meeting is expected to take a stock of Micro, Small & Medium Enterprises (MSMEs), which is under stress due to demonetisation and implementation of the Goods and Services Tax (GST).

This scheduled meeting comes in the backdrop of the surprise resignation by Urjit Patel earlier this week, citing personal reasons. The tussle between the finance ministry and the RBI was attributed as reason for the sudden exit of Patel, who would have completed his three-year term in September 2019.

According to sources, one of the key agenda for the upcoming board meeting will be the role of the central board in the decision-making of the RBI.

Given the current structure, the central board plays an advisory role but there is growing clamour to make it operational and have greater participation in key decisions of the central bank.

The government, as one of the important stakeholders, also wants greater involvement in the RBI's decision-making as it feels the current practice leaves it out on many critical issues such as single-day default turning a loan into an NPA, sources said.

However, former governors and other experts have pitched for the independence and autonomy of the RBI and want the board to play an advisory role.

The central board of the RBI is headed by the governor and includes two government nominee directors and 11 independent directors. Currently, the central board has 18 members, with the provision of going up to 21.

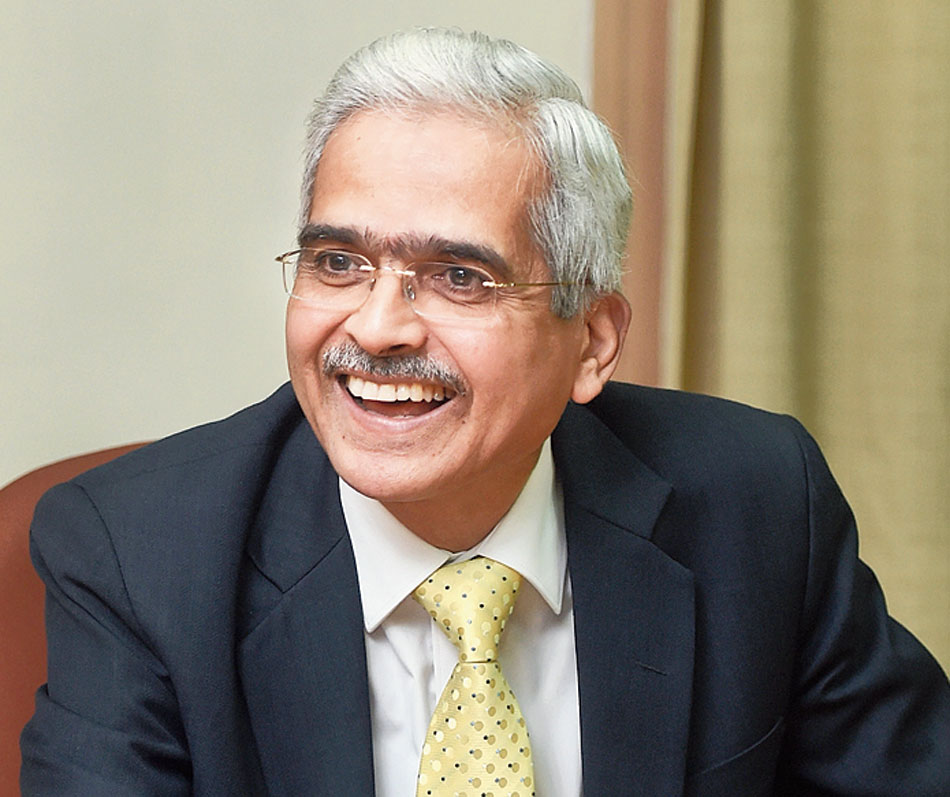

Soon after taking reins of the RBI, Das said he will try to uphold the autonomy, credibility and the integrity of the 'great institution' and take every stakeholder, including the government, along in a consultative manner.

The former economic affairs secretary, who took over as the 25th governor on Wednesday, said he would take measures that the economy requires in a timely manner.

On the second day, he held a consultation with heads of the Mumbai-based public sector bankers to discuss issues faced by them.

It is expected that a relaxation of the Prompt Corrective Action (PCA) framework for weak banks would also come up for the discussion under the new the governor.

Of the 21 state-owned banks, 11 are under the PCA framework — Allahabad Bank, United Bank of India, Corporation Bank, IDBI Bank, UCO Bank, Bank of India, Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Dena Bank and Bank of Maharashtra.

The PCA framework kicks in when banks breach any of the three key regulatory trigger points — namely capital to risk weighted assets ratio, net non-performing assets (NPA) and return on assets (RoA).

With regard to the economic capital framework, the governor said an expert committee, in consultation with the government, will be constituted soon to examine the issue.