Nestle India on Thursday announced its first-ever stock split of 10:1, while it reported a 37 per cent rise in net profit for the quarter ended September 30, 2023, bucking the trend set by frontline companies that have reported weak second quarter results.

The maker of Maggi noodles and KitKat chocolates also announced a second interim dividend of Rs 140 per share. The bundle of good news led to its shares jumping almost 4 per cent on the bourses on Friday.

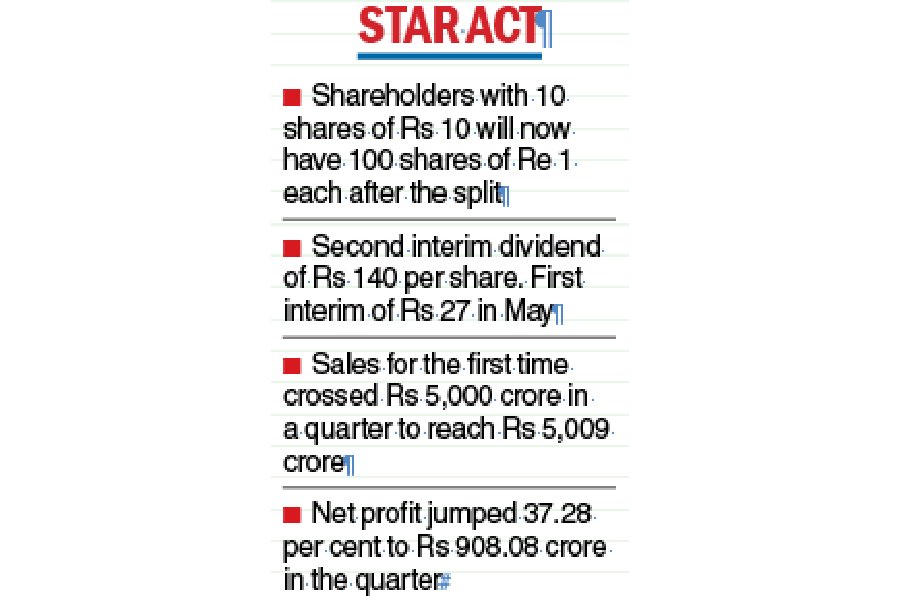

The Nestle board approved the stock split which will see the division of each share of Rs 10 into 10 equity shares of face value Re 1, subject to shareholder approval.

The number of outstanding shares will go up and the value will be one-tenth — at Thursday’s price, it will come at Rs 2412.2 — though there will be no impact on the market capitalisation solely because of the split.

Nestle India declared an second interim dividend of Rs 140 per share amounting to Rs 1,349.82 crore, which it said will be paid from November 16.

It had declared its first interim dividend of Rs 27 per share on May 8.

The company announced in July it will switch its financial year to April to March from January to December. So the current year will be a 15-month one till March 31, 2024.

For the quarter ended September 30, 2023, the company reported an increase of 37.28 per cent in net profit to Rs 908.08 crore compared with Rs 661.46 crore in the same period a year ago. Sales for the first time crossed Rs 5,000 crore in a quarter to Rs 5,009.52 crore against Rs 4,577.44 crore a year ago period, a rise of 9.43 per cent.

The rise in net profit

was helped by an exceptional item of Rs 106 crore which

the company said represented a write-back of provisions made in the earlier periods for an indirect tax matter upon the settlement of a dispute with the concerned state government.

“We are investing towards building our brand equity and have made strong and significant investments across all product groups.

“Consumer trends and increasing proclivity towards adoption of brands in small towns and large villages have propelled the growth of the company,” Nestle India chairman and managing director Suresh Narayanan said.

He said domestic sales grew in double digits, on account of mix, volume and price. Key brands continued to perform well, led by KitKat, Nescafe Classic, Nescafe Sunrise, supported by Munch and Milkmaid.

The Nestle India scrip closed at Rs 24,122 on the BSE a rise of Rs 852.35 or 3.66 per cent over the last close. It was the biggest gainer among the Sensex stocks.