In a backdrop marked by significant electoral wins, near-constant volatility across markets and the resultant shake-up for many coveted stocks, the one constant issue that investors of all sizes have raised can be summed up by just four words: “What are my returns?”

Indeed, the matter of ‘return on investment’, RoI in short, becomes a subject of discussion at every step, at every level. And it seems to acquire great traction in a bullish situation, especially when investors, having seen the index cross a record 40,000 points, are preparing to build their next big portfolio.

RoI — which holds the key to the overall evaluation of portfolio performance — will be our guiding spirit today. Here, we will begin by assuming that “return” is actually a popular but loosely-defined idea. We will also view the same in the context of “risk”, the more formidable metric. As everybody knows, the risk-return binary determines success and failure in today’s investment world.

Typically, the performance of a portfolio is ascertained on the basis of what it earns for the holder and the risk he has taken to earn it. Quite naturally, both return and risk will be determined by the asset class in question, the kind of securities held and the manner in which the portfolio is managed. With regard to an equity portfolio, the nature of diversification, the stock-selection policies, the market cap of these stocks will all be construed as crucial factors.

In the simplest possible terms, RoI for an investment will be determined by relating the earnings from it to the cost incurred to acquire it. Now, to make matters a bit more complex than that, I should remind you that returns will chiefly be shaped by two factors. The first will flow from periodic income, if any, by way of dividend. The second will arrive as gains recorded in valuation.

There are two secondary issues. Neither dividend nor advanced valuation would be known at the time of acquisition. Further, gains (or losses) can occur either at the time of sale or can be notional and unrealised. Whatever, these are important from the point of view of evaluation.

Key calculus: We will take up three of the most common concepts: absolute returns, annualised returns and compounded annual growth rate. A few brief pointers for each.

(Telegraph)

Absolute returns

This relates the earnings (dividend and capital gains) to the money spent to earn it. Mr Singh invests Rs 10,000 and earns Rs 900, while Mrs Sen invests Rs 5,000 and earns Rs 500 in a year. Who’s smarter? The absolute return (expressed in rupee) for Singh at Rs 900 is more than Sen’s. However, considering the latter’s smaller outlay (half of the former’s), that seems an unfair calculation, does it not?

The trick is to arrive at percentage returns. The “rate of return” is calculated thus: (Return on investment/original investment) x 100 We will leave the maths to you — at the end of the exercise you will find the lady in the example is the clear winner.

Annualised returns

Investment periods often range from the ultra-short to the decadal and longer. You really cannot compare returns generated by a stock held for, say, 10 years to that held by another for six months. The periods of holdings do not come anywhere close to each other.

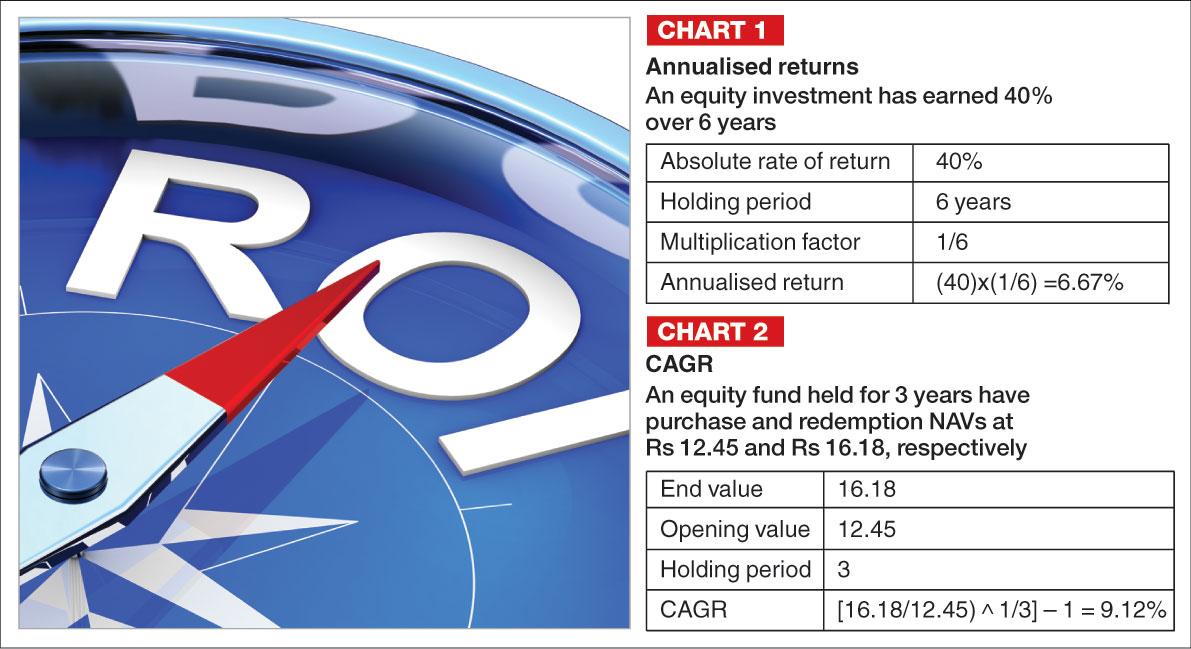

The solution lies in working out annualised returns. How is that achieved? Multiply the absolute rate of returns by a factor that is determined by how the holding period is represented. The factor to be used is 1/the number of years held (if the holding period is given in years). (See chart 1)

CAGR

CAGR, a rather well-accepted idea in investment circles, carries within it two formidable propositions — time value of money and compounding of returns. It deals with the mean return at which a particular investment has grown from end to end. It is also strictly formula-driven.

The formula is stated thus: [(End Value/Opening Value)ˆ1/n] - 1

Here, ‘n’ is the holding period, expressed in number of years.

Let’s take up CAGR in greater detail. Imagine an investment is held for a five-year period. The CAGR will be the average rate at which it advanced over this stretch of time. It will not give you any idea of the earnings that may have been recorded in any of the sub-periods. (See chart 2)

Returns, never without risk

No investment is risk-free, and a standard way of looking at risk is from the perspective of the fluctuations suffered by returns. It is generally observed that an investment carrying great risk can potentially deliver great returns. In fact, “higher the risk, higher the probable returns” has assumed the status of a canon. And this, dear investors, brings us to the other redoubtable concept: safety.

An excessively fluctuating investment is usually not considered safe by most investors. Take, for example, a stock that has yielded 40 per cent, 5 per cent and 24 per cent over three years. The fact that it has returned in double digits, the fact that it has beaten inflation, the fact that nothing else can readily match it will pale into insignificance for a conservative investor. He is probably someone who would be happy with a 9.5 per cent, provided the same has been given to him every year.

Whether you relate to him or not, remember to match your investment portfolio with your risk-taking abilities. Correct calculation of return will enable you to take a firm step towards this direction.

The writer is director, Wishlist Capital Advisors