The National Company Law Appellate Tribunal (NCLAT) on Friday declined to grant any stay to the proposed merger between Zee Entertainment Enterprises Ltd and Culver Max Entertainment formerly Sony Pictures Networks India (SPNI).

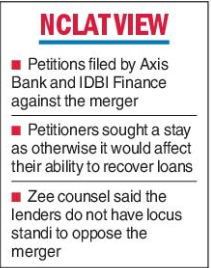

The appellate tribunal was hearing petitions filed by IDBI Bank and Axis Finance against an order of the National Company Law Tribunal (NCLT) that gave the green signal to the amalgamation.

A two-member NCLAT bench comprising chairman Justice Ashok Bhushan and member Arun Baroka listed the case for hearing on January 8 and directed Zee to file a reply.

IDBI Bank and Axis Finance had challenged the August 10 order of the Mumbai bench of the NCLT, which approved the Zee-Culver Max Entertainment merger.

The NCLT, in its order, dismissed some applications moved by financial institutions opposing the move, including those of IDBI Trusteeship, IDBI Bank, Axis Finance, JC Flowers Asset Reconstruction Co and Imax Corp.

This was challenged by IDBI Bank and Axis Finance before the appellate tribunal.

The matter was last listed on December 6 for a hearing. It was then adjourned to December 15.

While the matter was listed to a different bench in late October, it was transferred to the current bench, which is also hearing an insolvency appeal filed by IDBI Bank against Zee.

During Friday's hearing, additional solicitor general N. Venkatraman who appeared for IDBI Bank said the merger should be suspended because it would affect the lender’s ability to recover loans.

He pointed out that Zee had given guarantees for a loan taken by an Essel group entity.

Senior advocate Mukul Rohatgi who appeared for Zee objected to any stay and maintained the two lenders did not have the locus standi to object to the merger.

Shares of Zee on Friday were down 0.32 per cent at Rs 277.35 on the BSE. The sentiment has soured in the counter over apprehensions about the merger.

The focus is now on the December 21 deadline by which the parties have to decide whether they have to proceed with the merger or not.