The National Bank for Financing Infrastructure and Development (NaBFID) Bill 2021 introduced in the Lok Sabha says the proposed development finance institution (DFI) will get government guarantee support and direct access to liquidity from the Reserve Bank of India, which would help fund about 7,000 infrastructure projects .

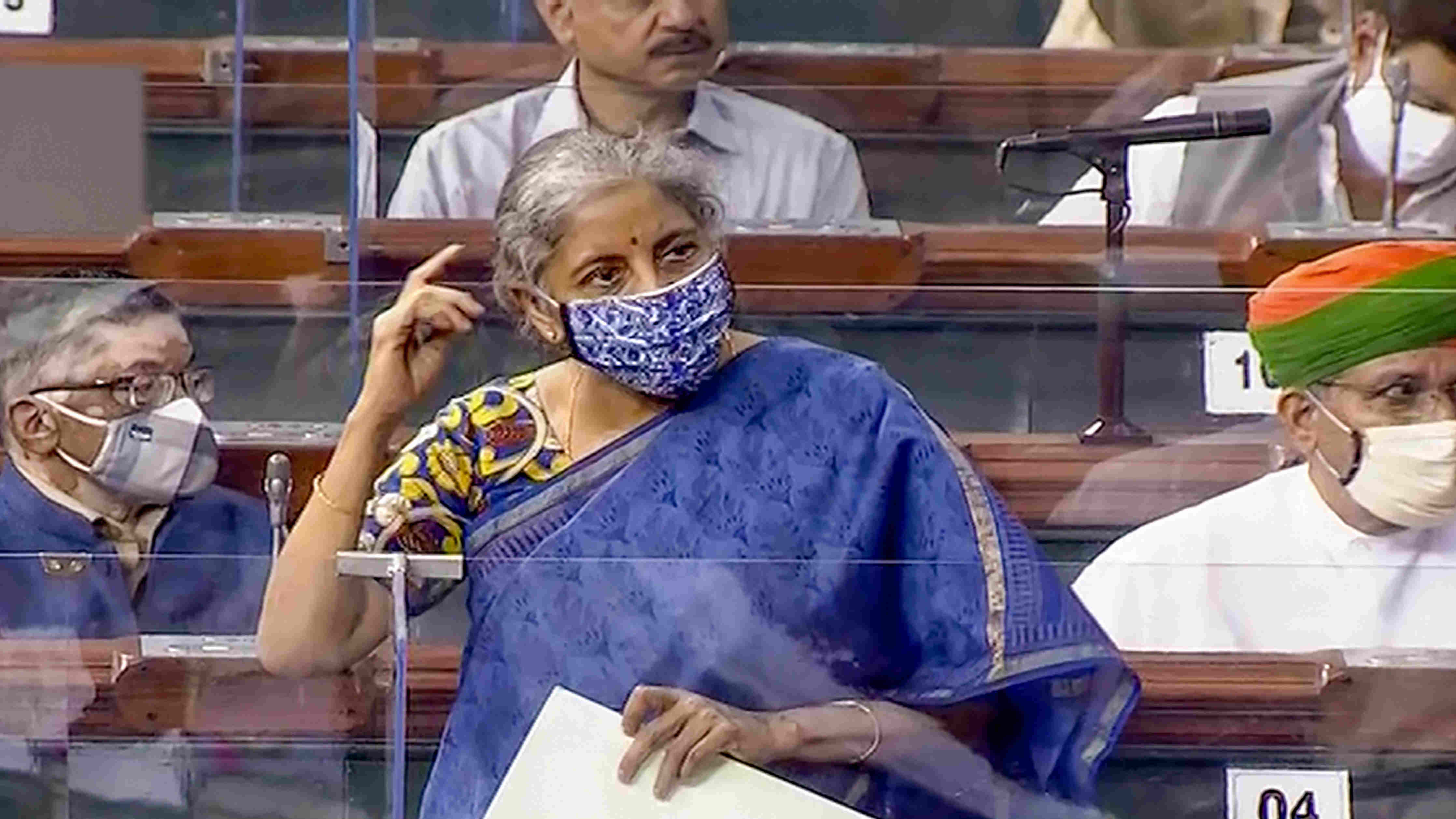

According to the statement of objects and reasons, introduced by finance minister Nirmala Sitharaman, the bill seeks to enable the central government, multilateral institutions, sovereign wealth funds and such other institutions to hold equity in the NaBFID.

The DFI will start with 100 per cent government ownership and raise low cost funds. Its borrowings can be guaranteed by the government, the bill said. “The Central Government may, on a request being made to it by the Institution, guarantee the bonds, debentures and loans issued by the Institution as to the repayment of principal and the payment of interest at such rate, terms and conditions as may be agreed by the Central Government.”

The guarantee will be provided at a concessional rate, not exceeding 0.1 per cent. This guarantee may be extended to the DFI for borrowings from multilateral institutions, sovereign wealth funds and such other foreign institutions as may be prescribed, the bill said. Hedging costs in connection with any borrowing of foreign currency may be reimbursed by the central government in part or in full, it added.

The bill said the developmental financial institution (DFI) will be permitted to “borrow money from the Reserve Bank repayable on demand or on the expiry of fixed periods not exceeding ninety days”.

These short term funds can be “borrowed against the security of stocks, funds or securities (other than immovable property) in which a trustee is authorised to invest trust money by any law for the time being in force in India.”

The DFI will also be able to borrow money from the Reserve Bank against bills of exchange or promissory notes arising out of bona fide commercial or trade transactions.