The Modi government has stepped in to cool runaway bond yields by cancelling this week’s auction scheduled to be held on Friday.

“On a review of the Government of India’s cash position, it has been decided, in consultation with Reserve Bank of India (RBI), to cancel auction of all the securities scheduled to be held on February 11, 2022 as per the calendar for issuance of Government of India dated securities during the second half of the current financial year,” the finance ministry said in a statement issued on Monday.

The RBI was supposed to auction Rs 24,000 crore worth of Government securities between February 7 and 11. Of this, a sum of Rs 10,525 crore was sold last Friday.

The government was planning to raise Rs 13,000 crore from the 10-year bond — more than half of the amount in this auction. With the yield on the 10-year paper shooting to 6.95 per cent last week, the government decided to cancel the sale.

After the auction was called off, the yield on the benchmark 10-year debt fell to 6.81 per cent from the previous close of 6.88 per cent.

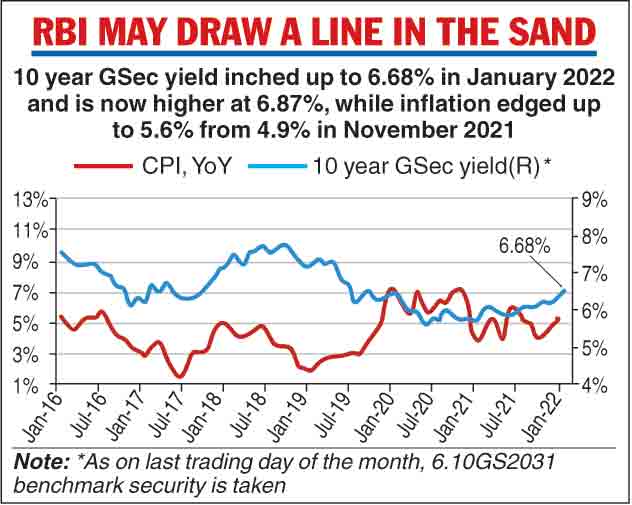

The markets have been worried about the huge supply of paper in the next fiscal year given the government’s decision to raise its gross borrowing of Rs 14.95 lakh crore. The announcement in the recent budget had started to push up yields (which are inversely related to prices) to an over two-and-half year high.

The attention has now shifted to the Reserve Bank of India’s three-day monetary policy meet which began on Tuesday in the expectation that the central bank will announce measures designed to ensure that the massive borrowing programme does not disrupt the market and yields.

The central bank is due to announce its monetary policy statement on Thursday and bond market experts are anticipating another bout of Operation Twist (which involves simultaneous purchase of long-term paper and sale of short-tenor government bonds) to steady yields.

“After the post-budget shocker for bond yields, all eyes are now on the MPC (monetary policy committee). Given the mammoth borrowing for 2022-23, there are hopes for RBI to announce an Operation Twist which could act as an anchor to long-term bond yields,” said Lakshmi Iyer, CIO (debt) & head - products, Kotak Mahindra Asset Management Company.

Bond market pundits believe that the 10-year yield will eventually rise to 7 per cent if no measures are adopted. The speculation is that the RBI could finally draw a line in the sand — and send out a message to the market indicating its tolerance limit on the yield.

Last year, when yields were inching up, the central bank was seen protecting the 6 per cent level for quite some time but eventually abandoned the plan. Later, RBI Governor Shaktikanta Das famously said last June that there was nothing ‘sacrosanct’ about the 6 per cent level. It remains to be seen what level the RBI will telegraph to the markets this time around.

Factors like firm crude oil prices, higher inflation globally and monetary policy tightening by various central banks have pushed up bond yields since December last year. The Union Budget delivered another shock when it did not announce any tax incentives for foreign portfolio investors (FPIs) investing in bonds.

The big disappointment is that the government has started to soft pedal on plans to list Indian bonds on a global index — ostensibly because of taxation issues that are currently being debated at the G-20.

If India worms its way into one of the global bond indices, it could lead to huge foreign fund inflows. So far this calendar year, while net investments by FPIs stood at Rs 5,194 crore in January, they have sold bonds worth Rs 1,425 crore, according to NSDL data.