Prime Minister Narendra Modi may keep silent on the Adanis but the embattled group’s troubles appeared to deepen on Thursday.

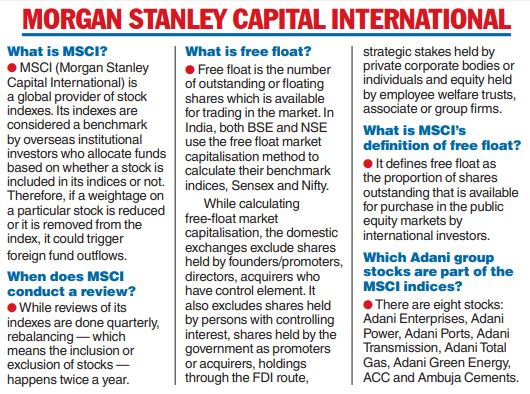

Morgan Stanley Capital International (MSCI) announced that it intended to review the free float of the eight Adani group stocks which figure in its indices that are closely tracked by the global investment community.

The Adani group’s market valuation swooned by over $100 billion after US short-seller Hindenburg Research released a report on January 24 levelling accusations of accounting fraud and stock price manipulation.

The MSCI announcement sent shock waves through the markets and sparked another meltdown in Adani group stocks, which was somewhat arrested by the circuit breakers.

Flagship Adani Enterprises saw its stock tumble by another 20 per cent to Rs 1,726.95 in early trades before closing at Rs 1,927.30, down 10.7 per cent, on the BSE. Other group stocks floundered as well.

The MSCI, which is due to publish the results of its review later in the day, said it had determined that “certain investors” in the Adani group “should no longer be designated as free float pursuant to our methodology” based on feedback that it had received from a “range of market participants”.

As a result of the review, some experts believe that the weighting of the Adani stocks in the four MSCI indices — India, Asia, emerging markets and all-country world stock indices — could be trimmed by as much as 50 per cent.

As a result of the review, some experts believe that the weighting of the Adani stocks in the four MSCI indices — India, Asia, emerging markets and all-country world stock indices — could be trimmed by as much as 50 per cent.

LIC signal

Signs of a potential damage control bid emerged on Thursday with the PTI news agency quoting LIC chairman M.R. Kumar as saying that the officials of the public sector insurer would soon meet the top management of the Adani group and seek clarification.

LIC’s investments in the Adani group stocks have come under criticism.

“Though our investor team has already sought clarifications from the Adanis, our top management could not contact them yet as we have been busy preparing the results. We are soon going to call them to meet us and explain. We want to understand what is happening in the market and in the group,” the chairman told reporters at the earnings conference on Thursday.

“We’ll be calling them in sometime soon to know how are they managing the whole crisis,” Kumar added.

The Hindenburg report had said several offshore funds and shell outfits that had invested in the Adani group companies were linked to the conglomerate “seemingly in blatant violation of SEBI exchange rules”.

Under listing rules, promoters cannot hold more than 75 per cent in the listed entity. The Hindenburg report expressed suspicions that four Adani group companies — Adani Enterprises, Adani Transmission, Adani Power and Adani Total Gas — were well over that threshold.

The report had said the suspect entities held 3.29 per cent in Adani Enterprises, 10.27 per cent in Adani Transmission, 5.98 per cent in Adani Power and 4.34 per cent in Adani Total Gas.

In the MSCI India Index, group flagship Adani Enterprises has a weightage of 85 basis points. The weightage of Adani Total Gas stands at 53 basis points, Adani Transmission at 51 basis points, Adani Ports at 44 basis points, Adani Green Energy at 35 basis points, Adani Power at 19 basis points, ACC at 20 basis points and Ambuja Cements at 32 basis points. They have different weightages in the MSCI Global Standard Index.

Observers said that of the eight listed stocks that are part of the MSCI indices, the least affected could be ACC, Ambuja Cements and Adani Ports — all of which have well-diversified public holdings.

Abhilash Pagaria of Nuvama Alternative and Quantitative Research said in a note that the MSCI was likely to lower the Foreign Inclusion Factor (FIF) — the free float adjustment factor applicable to foreign investors) — of the Adani group firms at its review and this would lead to weight reductions.

He added that the most impacted stocks would be the higher-weighted names in the index. He estimated that if the MSCI reduces the float of Adani Enterprises by 25 per cent, it could spark a selloff of about $110 million, which is 25 per cent of its current position in the index.

Brian Freitas, an analyst at Smartkarma, estimated that the MSCI is likely to lower the FIF of the Adani group firms in its review. However, the deletion of some stocks could happen in May.

Margin calls

A Reuters report said Norway’s sovereign wealth fund, the world’s largest stock investor, had sold its holdings in the Adani group at the start of the year, unloading stakes in three firms worth just over $200 million.

The $1.35 trillion fund at the end of 2022 held stakes in Adani Total Gas, Adani Ports & Special Economic Zone, and Adani Green Energy.

“Since year-end, we have further reduced in Adani companies. We have no exposure left,” Christopher Wright, the fund’s head of ESG risk monitoring, told a news conference on Thursday.

Environmental, social and governance (ESG) investing refers to a set of standards for a company’s behaviour used by socially conscious investors to screen potential companies for investment.

The Fund held a stake in Adani Total Gas worth $83.6 million, a stake in Adani Ports worth $63.4 million and a stake in Adani Green Energy of $52.7 million.

Earlier in the day, the Financial Times reported that the Adani group had been forced to pay off loans of $1.1 billion to creditors including Barclays, Citigroup and Deutsche Bank after a steep margin call from the lenders.

Three days ago, the Adanis had claimed that they had prepaid the loan — against which the promoters had stumped shares in group companies as collateral — to shore up investor confidence after the market rout.

The report said Adani group chairman Gautam Adani faced a margin call of more than $500 million on the $1.1 billion share-backed loan.

A Bloomberg report said the Group plans to prepay another $500 million loan next week to a group of banks including Barclays, Standard Chartered and Deutsche Bank.

Last week, analysts at JP Morgan had pegged the promoter loans at $1.8 billion. After the $1.1 billion payment, the rest may have to be paid too if the value of the pledged shares falls dramatically.

If the borrower is unable to meet the margin call, the lender will have the right to sell the pledged shares in the open market.