The banking system is witnessing a tightness in liquidity — it has slipped below Rs 1 lakh crore — which may pinch retail and corporate borrowers in the form of higher interest rates.

Liquidity has tightened because of GST and income tax outflows, the intervention of the Reserve Bank of India (RBI) in the forex markets and more importantly, limited government spending.

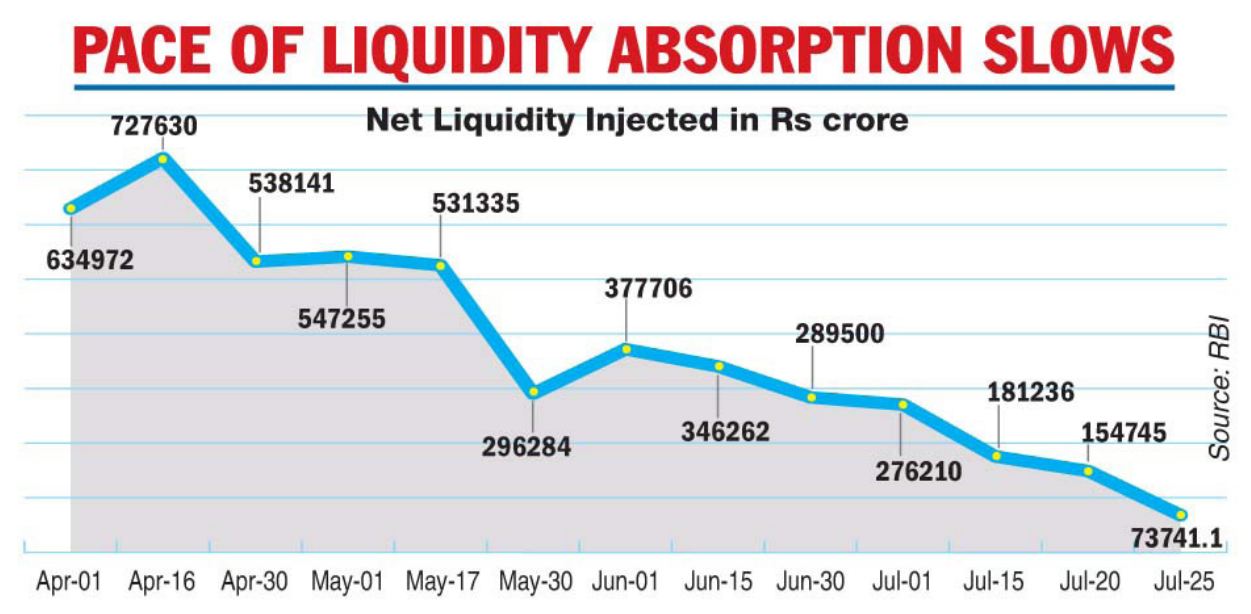

The liquidity as reflected from data on daily absorption from the RBI stood at Rs 73,741 crore as on July 25.

Surplus liquidity has been coming down due to the gradual normalisation undertaken by the central bank in its inflation fight, which has resulted in the policy repo rate being hiked on two occasions this calendar year.

This has led to the uncollateralised inter-bank call money rate rising above the repo rate.The RBI has always maintained that it wants to anchor this overnight rate around the repo rate which currently stands at 4.90 per cent.

Data from the central bank showed that while the weighted average call money rate was 5.06 per cent on July 25 — it moved in a range of 3.30-5.40 per cent — the weighted average overnight money market rate stood at 5.15 per cent, which is higher than 4.91 per cent last week.

Analysts said that this tightness in the system liquidity is on account of recent GST outflows, payment of income taxes ahead of the July 31 deadline and RBI’s intervention in the forex market to support the rupee.

Whenever the central bank sells US dollars, it sucks out rupee liquidity from the system. It is also on account of inadequate government spending. Experts estimate that the government’s cash balances with the RBI will be around Rs 3.7 lakh crore.

Speaking to The Telegraph, Upasna Bhardwaj, chief economist at Kotak Mahindra Bank, attributed the situation to limited government spending.

“If we look at on a net overnight basis, the marginal standing facility (MSF) is being tapped heavily and if we net out standing deposit facility (SDF) and the MSF, overnight there is borrowing from the RBI rather than lending. So there is fair amount of liquidity tightness which is clearly reflected in the overnight money market segment as well,’’ she added.