After a 190-basis point hike in the policy repo rate since May, some members of the monetary policy committee (MPC) are worried about growth.

Minutes of the meeting held by the interest rate-setting body show that two members have called for slowing the interest rate action even as others were in favour of continuing with the increases to anchor inflation.

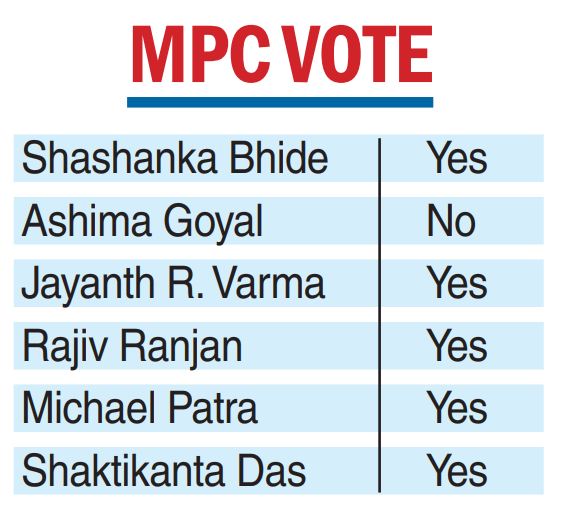

Following a three-day meeting that began on September 28, the six-member MPC had raised the repo rate by 50 basis points to 5.90 per cent, its fourth consecutive increase this year.

Ashima Goyal has warned that 100 per cent frontloading of interest rates can “easily overshoot’’.

She said large hikes were required in India to reverse the steep pandemic-time cuts and with that now complete, the RBI should go slow, which will allow its policy to be agile and data-based.

“Extremes are always dangerous... moderation is better,” she added. She pointed out that while most analysts are arguing for a 50 basis points rise just to preserve a spread with US policy rates, this is a fear-driven over-reaction.

Jayanth Varma felt that the MPC should take a pause. He observed that a hiatus is needed after this hike since monetary policy acts with lags. “It may take 3-4 quarters for the policy rate to be transmitted to the real economy, and the peak effect may take as long as 5-6 quarters. If we raise the repo rate to 6 per cent at this meeting, that would be a cumulative increase of around 2 percentage points in the space of just four months,’’ he noted.

Varma added that much of the impact of this policy action is yet to be felt in the real economy and even to the broader spectrum of interest rates.