The Centre on Thursday introduced the retro tax rollback bill in the Lok Sabha that allows the government to withdraw all the tax demands made on asset transfers prior to May 28, 2012, and refund the money collected on this count without any interest, provided the parties concerned take back all their tax cases against the government.

The tax proviso will, however, apply prospectively to all indirect asset transfers after that date.

The bill has a direct bearing on the government’s long running tax disputes with British firms Cairn Energy Plc and Vodafone Group.

The Indian government has lost two separate arbitrations brought by the two companies against the levy of retrospective taxes. While the government has virtually no liability in the Vodafone case, it has to refund $1.2 billion to Cairn Energy for the shares of the company it had sold, tax refund withheld and dividends confiscated.

The Taxation Laws (Amendment) Bill 2021 comes after a French tribunal last month ordered a freeze on some 20 centrally located properties belonging to the Indian government as part of a guarantee of the amount owed to Cairn.

Finance secretary T.V. Somanathan said the government would repay Cairn the Rs 7,900 crore it had collected as retrospective tax under the 2012 Act.

“We are monitoring the situation and will provide a further update in due course,” Cairn said in a late night statement on its website in response to the government’s tax law amendment.

Tax analysts, however, said the the refund of only the principal amount may not be seen favourably by the parties which have won arbitration awards.

Tax expert Narayan Jain said “after having lost the arbitration proceeding, the government had no choice but to withdraw the retro tax. It is doubtful whether Cairn and Vodafone would accept the rules in the present form. They would press for the interest component”.

Revenue secretary Tarun Bajaj said “we have taken this bold step to assure the investor community about the predictability in the tax regime. The retrospective taxation continued to be a sore point and hence the government has voluntarily decided to bring in this bill to nullify all retro tax demands”.

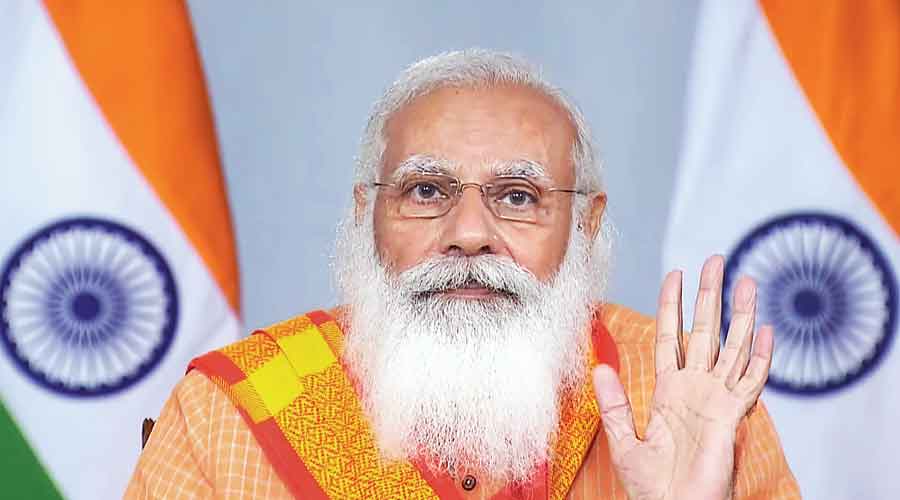

With this amendment, the Centre is finally coming good on the promise that the then finance minister Arun Jaitley made in his budget speech in 2014 that the Modi government would not raise retrospective tax demands.

However, the Centre has failed to also knock down its tax law amendment in the Finance Bill 2017 — with a roughly 55-year retrospective effect — that permitted tax sleuths to raid assessees based on a rumour, canard, whim or unsubstantiated suspicion without having to disclose to anyone the source or the basis of the information on which the operation was ordered.

Amazon verdict

The Supreme Court is scheduled to pronounce on Friday the verdict on e-commerce giant Amazon’s pleas against the merger of Future Retail Ltd with Reliance Retail and is likely to decide whether Singapore’s Emergency Arbitrator (EA) award, restraining the Rs 24,731-crore deal, was valid under Indian law and can be enforced.

As per the apex court website, the verdict would be pronounced at 10.30am by a bench of Justices R F Nariman and B R Gavai.