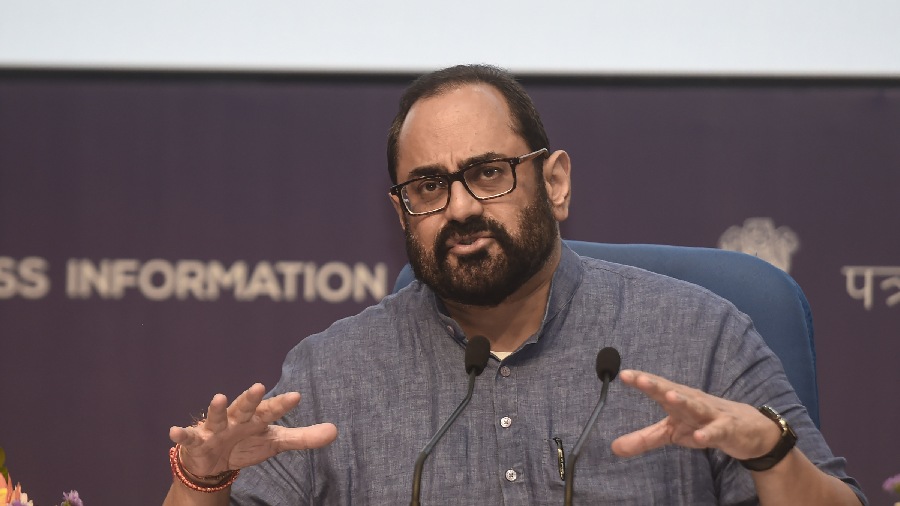

Minister of State for Electronics and IT Rajeev Chandrasekhar will meet representatives of start-ups this week to assess the impact of their exposure to Silicon Valley Bank which was deeply entrenched in the tech startup ecosystem. According to various industry players and experts, most Indian software-as-a-services startups with a presence in the US and firms linked to incubator Y Combinator are among entities that will feel the heat of the Silicon Valley Bank collapse but the impact is likely to be short-term.

"The SVB_Financial closure is certainly disrupting startups across the world. Startups are an imp part of NewIndia Economy. I will meet wth Indian Startups this week to understand impact on thm n how @narendramodi govt can help durng this crisis," Chandrasekhar tweeted on Sunday.

SVB was deeply entrenched in the tech startup ecosystem and the default bank for many high-flying startups; its abrupt fall marked one of the largest bank failures since the 2008 global financial crisis.

Industry watchers expect a quick takeover of the bank as it has enough assets that can be liquidated to return money to the clients.

Y Combinator-backed startups get their payments in the accounts they hold in SVB but many of Indian firms linked to incubators like Meesho, Razorpay and Cashfree Payments have said that they have no exposure to the crisis.

Y Combinator-incubated Indian startup Snazzy's co-founder and CEO Ayush Pateria said that most Indian startups, incubated at Y Combinator, who are exposed to SVB, are in their early stage.

Fintech firm Recur Club founder and CEO Eklavya Gupta said that there are some large-size SaaS companies on the west coast with operations in the US and India, who have had significant exposure to SVB.

Except for the headline, this story has not been edited by The Telegraph Online staff and has been published from a syndicated feed.