Larsen and Toubro may consider a merger of the two infotech companies under its wing — L&T Infotech and Mindtree.

A Bloomberg report quoting sources said the boards of Mindtree and L&T Infotech could consider the share swap ratios for the merger as early as next week.

While the L&T Infotech scrips were down 2.66 per cent, Mindtree fell 3.33 per cent at the Bombay Stock Exchange. Both companies termed the report as speculative.

“We wish to submit that as a policy, the company does not comment on any speculation in the market/media. At present, we do not have any information that is required to be disclosed in accordance with the Sebi (Listing Obligations and Disclosure Requirements) Regulations, 2015,” said L&T Infotech.

“We wish to clarify that news reports of a merger between Mindtree and L&T Infotech are speculative in nature. In this regard, we would like to state that there is no information available with the company as of today, which is required to be reported under extant Sebi (Listing Obligations and Disclosure Requirements) Regulations, 2015, and which may have a bearing on the stock price of the company,” said Mindtree.

According to market observers, the merger, if it happens, will result in cost synergies for both the companies particularly in terms of managing human resources. But it remains to be seen how the board of the combined entity takes shape and who leads the company.

At present, Mindtree’s CEO and managing director is Debashis Chatterjee and L&T Infotech’s CEO and managing director, Sanjay Jalona.

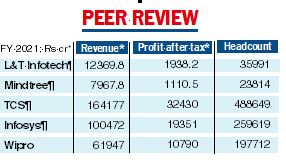

In 2020-21, the revenue of L&T Infotech in rupee terms was Rs 12,369.8 crore, while that of Mindtree was Rs 7,967.8 crore according to their annual financial disclosure.

While L&T Infotech’s profit after tax was Rs 1,938.2 crore, profit after tax of Mindtree was Rs 1,110.5 crore.

Larsen acquired control of Mindtree in 2019. The conglomerate holds about a 61 per cent stake in the company, which has a market value of $8.3 billion, and has around 74 per cent of L&T Infotech, which has a market capitalisation of $13.6 billion, data compiled by Bloomberg show.

In July 2019, a regulatory filing from Mindtree said: “We wish to inform that L&T has acquired equity shares to an extent of 60.06 per cent of the total shareholding of the company and has acquired control and is categorised as promoter according to Sebi Regulations, 2018.”

At the time, L&T CEO S.N. Subrahmanyan had said: “Mindtree will be run as a separate entity, distinct from L&T Infotech and L&T Technology Services. The entities would run at an arm’s length. It is inappropriate to speculate about the future structure now.”

Mindtree net

Mindtree on Monday said it has registered a 49.1 per cent jump in its consolidated net profit at Rs 473.1 crore in the fourth quarter ended March 31 compared with the year-ago period. The company had recorded net profit of Rs 317.3 crore in the same period of the previous fiscal.

Consolidated revenue from operations grew 37.4 per cent to Rs 2,897.4 crore during January-March 2022 from Rs 2,109.3 crore a year ago.

in the corresponding quarter of 2020-21.

For the financial year 2021-22, consolidated net profit of Mindtree grew 48.8 per cent to Rs 1,652.9 crore from Rs 1,110.5 crore at the end of financial year 2020-21.

The consolidated revenue of Mindtree rose to 10,525.3 crore at the end of 2021-22 from Rs 7,967.8 crore a year ago.

“Our full year revenue growth of 31.1 per cent validates our strategy to capitalise on rising demand by diversifying our services portfolio, mining customers, and broadening industry partnerships. We are proud to have delivered EBITDA margin of 20.9 per cent and PAT margin of 15.7 per cent, our highest in a decade,” Mindtree chief executive officer and managing director Debashis Chatterjee was quoted as having said in a statement.

He said a full year dividend of Rs 37 per share announced by the company the is highest in its history. “We are increasing investment in metaverse technology,” Chatterjee said.