The mid-tier IT services player said the board held a long meeting on the prevailing situation at the company and decided to immediately constitute a committee of independent directors in the interest of all stakeholders to provide their reasoned recommendation in respect of the “unsolicited offer” by L&T for the consideration of the shareholders.

Mindtree said the directors panel will consider and evaluate all aspects of the offer made by L&T, taking into account all relevant facts, circumstances, data related to the company and industry and the interest of all stakeholders involved.

“This committee will discharge the legal obligations placed on the independent directors under the prevailing regulations with respect to providing reasoned recommendations on the unsolicited offer by L&T…

“The committee will be supported by independent legal and financial advisers to help it with its deliberations,” Mindtree added.

According to the public announcement made by L&T, the panel must submit its recommendations for the open offer by May 10.

L&T said in the announcement the objective and purpose of the acquisition of a controlling stake in Mindtree was in line with a strategy to grow the revenue and profit of its asset-light services business portfolio, thereby increasing the consolidated return on equity and further diversify the consolidated group revenue and profits.

It added that the acquisition was expected to be value accretive for both its shareholders and the shareholders of the target firm in the medium- to long-term.

L&T had earlier entered into a deal to buy Siddhartha’s stake in Mindtree. Moreover, it has placed an order with brokers to pick up another 15 per cent. The latter will be done only after the receipt of approvals from various regulatory authorities. Post the acquisition of shares under the purchase order, L&T’s stake will jump to 35.44 per cent. After the open offer, it will rise to over 66 per cent.

IT-services firm Mindtree on Tuesday dumped its plan to buy back its shares to counter a hostile takeover bid by engineering-to-construction giant Larsen & Toubro.

L&T in a separate announcement said its open offer to acquire a 26 per cent stake in Mindtree would open on May 14 and end on May 27 even as its broker shops for another 15 stake in the tech company, adding to the 20.32 per cent stake it had already acquired from Café Coffee Day owner V.G. Siddhartha.

In a further sign of retreat, the Mindtree board has formed a panel of independent directors to examine L&T’s open offer. The promoters of Mindtree, who together hold 13.32 per cent, had claimed large institutional investors who hold 39 per cent of the shares were backing the board.

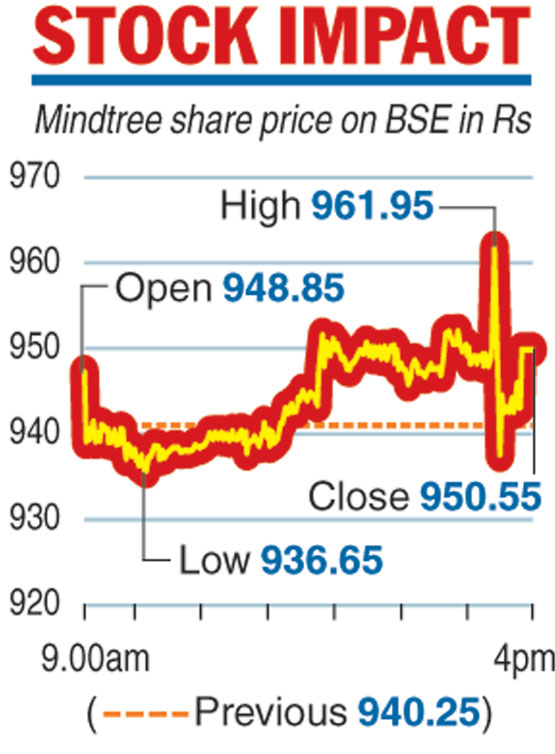

L&T in its open offer proposes to acquire 5.13 crore shares of Mindtree for Rs 980 per share aggregating Rs 5,030 crore. The Mindtree shares closed at Rs 950.55 on the BSE on Tuesday, a gain of Rs 10.30, or 1.10 per cent.

In a regulatory filing with the stock exchanges after market hours, Mindtree said the board had formed a committee of independent directors under lead independent director and Radio City CEO Apurva Purohit to provide its recommendation on the “unsolicited offer” made by L&T.

“The board of directors of the company, at its meeting held on March 26, has decided not to proceed with a buy-back of equity shares of the company,” it added.

Mindtree was constrained by market rules on the buyback. Sebi rules say a company cannot make changes to its capital structure after an open offer was announced, unless it gets the approval of 75 per cent of shareholders through a special resolution.

The Telegraph