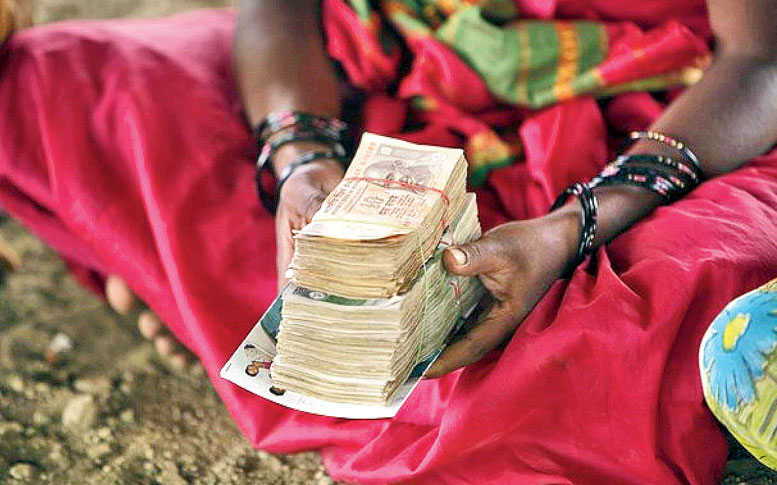

The microfinance industry has posted a 29.26 per cent rise in gross loan portfolio at the end of March 31, 2020, along with a rise in accounts and the overall portfolio at risk.

According to data compiled by Microfinance Institutions Network (MFIN), the gross loan portfolio as on March 31, 2020, was Rs 2,31,788 crore against Rs 1,79,314 crore as on March 31, 2019.

Banks hold the largest share of portfolio in micro-credit with a total loan outstanding of Rs 92,281 crore, which is 39.8 per cent of the total microcredit universe. There has been a 54 per cent rise in portfolio outstanding on a year-on-year basis for banks.

NBFC-MFIs are the second-largest provider of micro-credit with a loan amount outstanding of Rs 73,792 crore, accounting for 31.8 per cent of the total industry portfolio.

Small finance banks have a total loan amount outstanding of Rs 40,556 crore with a total share of 17.5 per cent. Non-bank finance companies account for another 9.8 per cent and other MFIs account for 1.1 per cent of the universe.

“In a difficult year, it is heartening that microfinance was able to get more liquidity from its lenders and in turn increase its outreach by adding new branches and hiring more staff,” said Harsh Shrivastava, CEO of MFIN.

Total number of active microfinance loan accounts stood at 10.54 crore as on March 31, 2020, an increase of 21.65 per cent over 8.66 crore loan accounts as on March 31, 2019.

The portfolio at risk stood at 1.79 per cent at the end of the fourth quarter of 2019-20, up from 1.56 per cent in the third quarter.