The sale of pledged shares appears to expose the vulnerability of the promoters who have now pledged 98.5 per cent of their 38.40 per cent stake in the company.

The Khaitans have pledged most shares with IndusInd Bank Ltd, which holds 23.84 per cent of the shares as pledged. Vistra ITCL (India) Ltd, Yes Bank, HDFC Ltd, IL&FS Financial Services Ltd are some of the other companies with whom the promoters have pledged shares, filings with the bourses show.

Vistra holds the pledged shares as the trustee on behalf of joint lenders such as IL&FS Financial Services, IL&FS Infrastructure Debt Fund and ABFL.

Credit rating agency ICRA has downgraded the debt instruments of McLeod twice in two months. According to an estimate, based on disclosures made on the bourses, McLeod has sold close to 41 million kg of tea production and raked in about Rs 1,150 crore.

Corporate watchers in Calcutta said the indebtedness of the promoters of McLeod Russell mostly arose from one of their group firms, McNally Bharat Engineering Company. The outstanding borrowing of McNally Bharat stood at Rs 1,338 crore as on March 31, 2019.

Aditya Birla Finance Ltd, the non-banking finance company from the stable of Aditya Birla Group, has fully offloaded the shares that Brij Mohan Khaitan’s McLeod Russel Ltd had pledged with them.

Woodside Parks Ltd, a Khaitan family vehicle, had held 45,068,01 shares in McLeod Russell, one of world’s top producers of bulk tea. The shares translated into a 4.31 per cent stake.

ABFL sold the shares in six tranches which rocked the McLeod scrip in the market. In a span of seven days starting from April 30, the company sold out 41,423,39 shares in the open market.

On Tuesday, McLeod Russell informed the bourses that the remaining pledged shares held by ABFL had also been sold. The transactions involving 3,64,462 shares, representing 0.34 per cent share of the company were offloaded in the market during May 16-17.

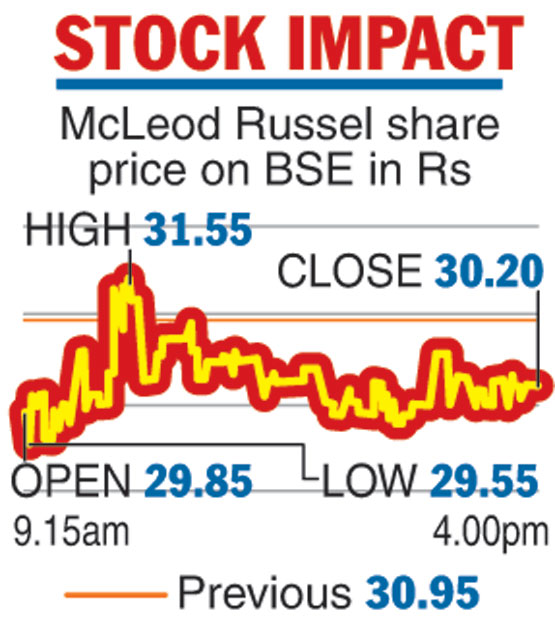

From a high of Rs 76.40 apiece at the close of trading on April 26 — a day before the NBFC started selling the pledged shares — the stock closed at Rs 30.20 on Tuesday, a decline of over 60 per cent.

The market cap of India’s largest producers of bulk tea now stands at Rs 330.56 crore going by the closing price on the bourses. The company has tea gardens in India (Assam and Bengal), Africa (Uganda) and Vietnam, having annual production capacity of close to 75 million kilogram.

The Telegraph