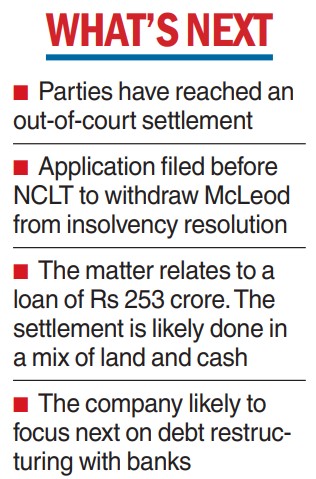

The promoters of McLeod Russel and IL&FS Infrastructure Debt Fund have reached an out-of-court settlement to amicably resolve their dispute over a loan default, allowing India’s largest bulk tea producer to wriggle out of insolvency yet again.

An application has been filed before the National Company Law Tribunal, Calcutta under section 12A of the Insolvency & Bankruptcy Code (IBC) to withdraw the company from the corporate insolvency resolution process (CIRP).

The application was filed by the interim resolution professional Ritesh Prakash Adatiya who was appointed by the NCLT after McLeod was sent to CIRP on February 10.

“I have received an application from the creditor IL&FS Infrastructure Debt Fund in form FA informing that it has settled with the promoters of McLeod Russel. Subsequently, I have applied NCLT under Section 12A to withdraw the CIRP matter,” Adatiya told The Telegraph on Tuesday.

Once the NCLT approves the application, McLeod Russel will be out of CIRP. At present, the insolvency proceeding is under a stay pronounced by the National Company Law Appellate Tribunal. The McLeod matter was listed before the NCLAT on Tuesday. However, it has now been adjourned to Friday following the settlement.

A spokesperson for IL&FS declined to comment on the development citing the matter as sub-judice. The Khaitan family of Calcutta, the promoters of McLeod, also declined to comment.

Sources said the Khaitans are settling a large part of the dues by offering land. The insolvency case pertains to a Rs 252.66 crore loan that IL&FS Debt Fund had lent to two of the holding companies of the Khaitan family viz. Babcock Borsig Ltd and Williamson Magor & Co Ltd in 2017.

McLeod had executed a ‘’shortfall undertaking’’ in favour of IL&FS Infra Debt Fund about the loan. The two promoter group companies had defaulted in servicing the debt obligations, leading IL&FS to file a petition against the tea producer under Section 7 of IBC.

With the pending normal interest and penal interest, the total default amount is Rs 347.47 crore. Sources indicated IL&FS IDF is likely to have recovered a lion’s share of the principal amount from the Khaitans even as the details of the settlement, being offered in a mix of land and cash, remained under wraps.

Once the company is taken out of the CIRP, the promoters are likely to focus on restructuring the company’s outstanding debt with the banks, which have proposed a one-time settlement of dues which run to about Rs 1,600 crore.

Before McLeod was sent to the CIRP, it had entered into an exclusive talk with Carbon Resources to jointly explore OTS with banks. Those negotiations would likely start afresh. However, the promoters have to settle with a few other creditors such as KKR before the debt settlement with banks is done.

It is the second instance in as many years when Khaitans saved Mcleod, which has 33 gardens in India producing 44 million kg of tea, from going under.

In 2021, McLeod was dragged to the CIRP by Techno Electric & Engineering Co Ltd. However, the Khaitans wriggled out of the pickle by settling with the creditor.