Stock markets sank worldwide, currency markets wobbled with the rouble plunging to a record low and terrified investors scrambled to the safety of top-rated government bonds and gold after Russian President Vladimir Putin mounted an assault on Ukraine by land, sea and air in the biggest attack on a European state since World War II.

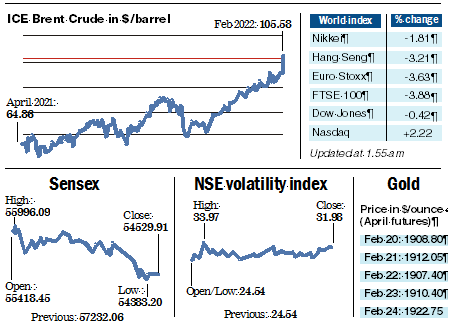

The pre-dawn raid sent Asian stock markets skidding on a day of frenetic trading at the end of which Hong Kong’s Hang Seng index plunged 3.2 per cent — its biggest daily loss in five months — and Japan’s Nikkei 225 lost 1.8 per cent while China’s Shanghai Composite moved 1.7 per cent lower.

The frisson of fear rippled through India where the Sensex nosedived by about 2850 points in intra-day trades taking the bellwether index below the 55000 mark before closing at the end of a volatile day of trading with a loss of 2702.15 points, or 4.72 per cent.

The Indian markets fell the most during a torrid day of trading that wiped out investor wealth worth Rs 13 trillion.

“Geopolitical events often come up with short-term reactions in the market as the dominant news flow leads to market volatility…We believe the present macroeconomic developments are leading to volatility in all major asset classes, including equity and debt.

“The volatility is here to stay for some time before we conclude a market direction. Investors should focus on asset allocation and use this volatility to build long-term positions in quality large and mid-cap stocks as they become attractive after the recent correction and provide a good entry point,” said Naveen Kulkarni, chief investment officer of Axis Securities.

In Thursday’s trade, all the Sensex stocks ended in the red with IndusInd Bank crashing the most by 7.88 per cent, followed by M&M, Bajaj Finance, Axis Bank, Tech Mahindra and Maruti.

The broader markets were also weak with the Nifty mid-cap 100 index plunging 5.74 per cent and the Nifty small-cap 100 falling by 6.25 per cent.

The yield on India’s 10-year bond surged to 6.7935 from 6.7585 on Wednesday amid talk that the Reserve Bank of India’s intervention in the past few days had been able to limit the volatility to just 3.5 basis points on a day of market turmoil. A rise in the 10-year yield has big implications for the cost of the Modi government’s borrowing.

Carnage in Europe

Putin’s assault was described by commentators as a cataclysmic event of Europe as the carnage raged through its markets. Europe’s stock markets tumbled nearly 4 per cent in panic selling and Wall Street opened down 2.5 per cent. The US dollar jumped and the Russian rouble tumbled to a record low.

People demonstrate in support of Ukraine in London on Thursday. AP/PTI

The dollar index rose 1.501 per cent and was set to record its biggest daily percentage gain since March 2020 when the markets were in the throes of the first wave of the Covid-19 pandemic.

The greenback reached a high of 97.740 against a basket of major currencies, its highest since June 30, 2020. In contrast, the Russian rouble weakened 6.70 per cent versus the greenback at 86.92 per dollar after softening to a record low of 89.986 per dollar.

Gold spikes

World gold price spiked to $1950 per ounce — a 13-month high. In India, the price of gold on the Multi Commodity Exchange (MCX) climbed to its highest level in a year at Rs 52,710 per 10 gram while silver jumped Rs 3,512 to Rs 68,097 per kg.

Both Ukraine and Russia are big crop producers. As a result, wheat and corn prices surged more than 5 per cent.

(With inputs from Reuters)