Markets are trying to figure out whether Reliance Industries will announce any steps to unlock value as India’s No. 1 private company triggers a capex cycle that has led to net debt rising again.

The combination of elevated capex and the net debt graph moving upwards has resulted in the RIL stock underperforming the benchmark indices this year and hitting a 52-week low of Rs 2,180 on March 20.

The stock has been buffetted by other headwinds such as rising interest rates, a bearish condition in the overall markets because of the global banking crisis and the FPI pullout from riskier assets such as equities.

The stock has fallen almost 14 per cent so far in 2023 against a nearly 5.50 per cent drop in the BSE Sensex.

With capex likely to remain elevated in the next fiscal, the question of listing its consumer-facing businesses comprising Jio and Reliance Retail has cropped up again.

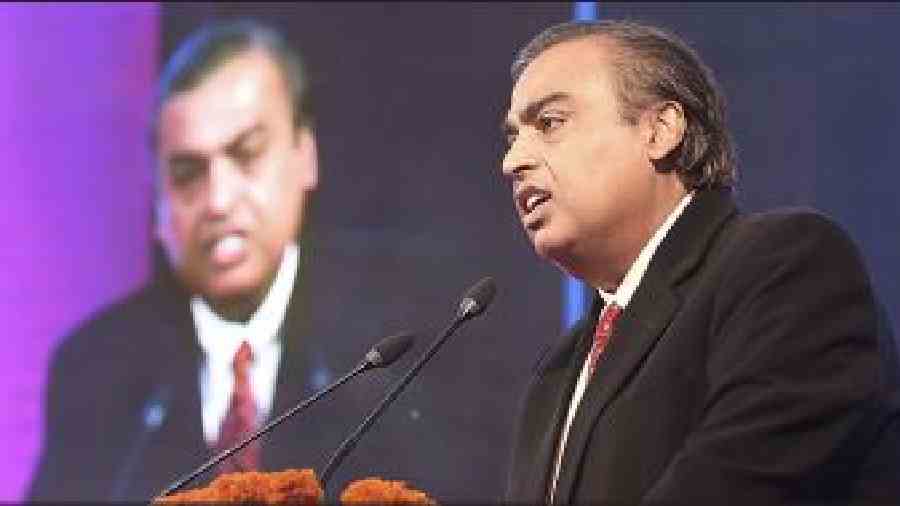

Reliance chairman Mukesh D. Ambani had told shareholders at its annual general meeting in 2019 that it would "move towards listing of both these companies within the next five years’’.

Observers now do not rule out the possibility of listing in the next fiscal.

Analysts attributed the rise in capex to investments in 5G and the brisk expansion of the retail business.

Brokerage Jefferies said in a recent report that RIL’s capex will moderate only in 2024-25.

“Retail floorspace addition will be slow, and 5G roll-out will largely be behind us in FY25E (Estimated 2024-25). We see pace of capex slowing FY25E onwards, with green energy the major driver beyond FY25. We note green energy is much less capital intensive than conventional energy,’’ they said.

Jefferies said capex should rise to $16.9 billion in the current fiscal from $13.4 billion in 2021-22. It is projected to peak at $17.8 billion in 2023-24 and decline to $17.1 billion in 2024- 25.

The rise in capex has resulted in the net debt heading northwards. It stood at Rs 110,248 crore at the end of December 31, 2022 compared with Rs 93,253 crore in the preceding three months.

RIL has admitted the rise in net debt is due to “capex funding’’ as it accelerated investments towards 5G rollout and ramp-up in retail operations.

Analysts, however, differ on whether its cash flows will be strong enough to keep a lid on the debt levels.

"With RIL in the midst of its next wave of investments toward 5G rollout, new energy giga factories and consumer brands, capex needs are likely to outpace cash generation over the next two years. This could keep ROCE below potential till new businesses become self-sustainable,’’ Kirtan Mehta of BOB Capital Markets said in a report earlier this year.

Others of the view that a robust performance particularly of its oil-to-chemical (O2C) business will not push the net debt to uncomfortable levels.

Sudeep Anand and Prathmesh Kamath of Systematix Insitutional Equities estimate capex may remain elevated over next few years.

Reliance is expected to invest $9 billion towards petchem expansion, according to their calculations. They said it will invest $10 billion on new energy, Rs 88,000 crore on 5G spectrum — in 20 annual installments — apart from its 5G roll out and regular capex in all segments.

They have estimated capex at Rs 1.4 lakh crore in this fiscal, which will come down to Rs 1.3 lakh crore in the next fiscal and rise to Rs 1.4 lakh crore in 2024-35.

Reliance net debt will go up to Rs 1.8 lakh crore in 2024-25 from Rs 1.4 lakh crore in 2022-23.

However, RIL’s EBITDA to net debt would remain comfortable at 1x, with net debt to equity at 0.2x.

Back in 2019 when its debt had generated some concern, Ambani had laid a road map to become a zero net-debt company within 18 months. It had a net debt of Rs 1.61 lakh crore during the quarter ended March 31, 2019.

But, a string of mega deals in Jio Platforms, a rights issue of over Rs 50,000 crore had seen RIL becoming net debt free in June 2022, eight months ahead of the March 2021 deadline that Ambani had then set.

The question now is with debt levels seen rising again, will Ambani soon take the value unlocking route which would not only bring it down, but also give a fresh life to the stock.