Indian share prices slumped on Friday following a meltdown in global equities as investors struggled to come to terms with the RBI’s 40-basis-point hike in the repo rate that will ratchet up the borrowing costs for industry and moderate growth.

The rupee too fell on Friday and came close to its record low in intra-day trades, before the RBI intervened to shore up the currency.

The Indian currency rappelled down to 76.95 to the greenback intra-day, close to its historic low of 76.98 on March 7. It finally ended at 76.92 to the dollar marking a fall of 57 paise over the last close.

IFA Global, a forex advisory firm, said a rapid shift towards higher interest rates by major central banks across the globe soured the outlook on emerging market assets, wreaking havoc on domestic equity and bond markets — and pushing up the value of the dollar. Moreover, the stronger dollar globally and elevated crude prices dented the sentiment on the rupee.

Industry has not reacted positively to the 40-basis-point increase in the policy repo rate and the 50 basis points rise in the cash reserve ratio (CRR) saying that the twin moves will further crimp demand.

The fear is this is just the beginning of a rate hike cycle by the RBI and that another 75-100 basis points increase is on the table as inflation is expected to remain elevated.

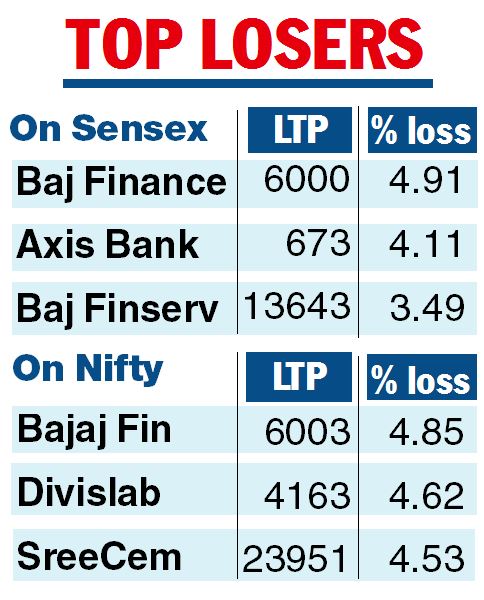

The 30-share Sensex opened lower at 54928.29 and fell 1115.48 points to an intra-day low of 54586.75. It later settled at 54835.580 — a loss of 866.65 points or 1.56 per cent. Similarly, the broader Nifty 50 cracked 271.40 points or 1.63 per cent to finish at 16411.25.

“The equity markets continued to remain extremely volatile after the repo rate and CRR hike by the RBI. The prospects of further rate hikes remains strong against the background of the need to tame the soaring inflation at any cost,” Joseph Thomas, head of research, Emkay Wealth Management said.

“Rising interest rates and dwindling liquidity remain the twin enemies of equities anywhere.’’

Meanwhile, government security prices continued to feel the heat of elevated inflation and RBI’s monetary tightening.

Yields on the benchmark 10-year security climbed to 7.45 per cent after hitting a high of 7.47 per cent during the day. On Thursday, it had closed at 7.40 per cent.