Equities consolidated their position for the third straight session on Friday — while ruling at near four-week highs — on hopes of moderation in inflation because of declining commodity prices.

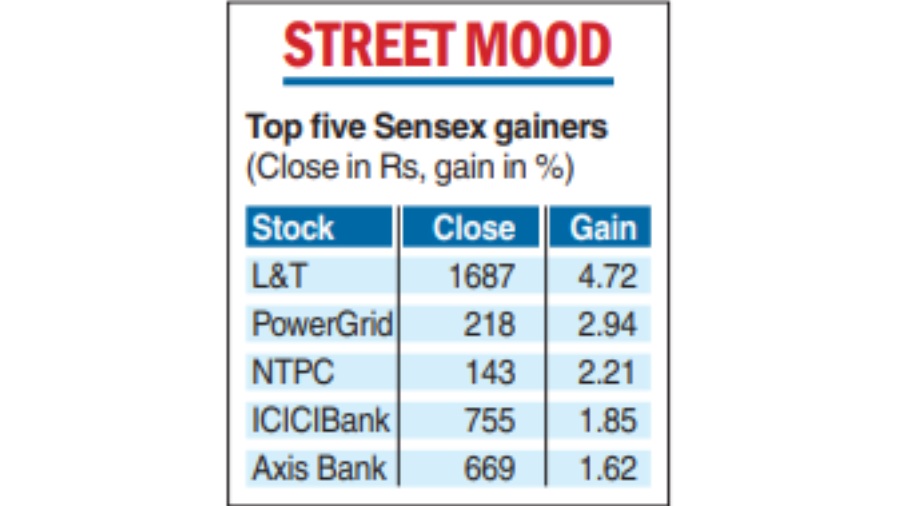

While the 30-share BSE Sensex gained 303.38 points or 0.56 per cent to settle at 54481.84, the broader NSE Nifty finished higher by 87.70 points or 0.54 per cent to 16220.60.

Investors were seen buying banking, FMCG, and infrastructure stocks on optimism about global central banks going slow in raising interest rates as commodity prices have shown a declining trend.

Amid attractive valuations after the recent correction, the bet is on the sectors witnessing a revival as lower input costs improve their margins.

``The rise in the equity markets witnessed in the last few trading sessions of this week was based on this outlook of probable moderation in inflation, and therefore of rates. However, the actual inflation numbers will be released in the US and India in the coming week, and this would be crucial in deciding the trajectory of the markets,” said Joseph Thomas, head of research, Emkay Wealth Management.

At the broader level, the BSE small-cap index rose higher by 0.28 per cent and the mid-cap index gained 0.20 per cent.

Among BSE sectoral indices, capital goods jumped 2.23 per cent, followed by power (1.71 per cent), utilities (1.58 per cent), industrials (1.51 per cent), bank (0.66 per cent) and FMCG (0.54 per cent). Metal, basic materials and telecom remained under pressure.

According to Siddhartha Khemka, head — retail research, Motilal Oswal Financial Services, the Nifty has recovered 7 per cent from its recent low of 15183 as the fall in crude and commodity prices provided some relief. The valuation at around 17.5 times one-year forward earnings has made the Nifty attractive which led to value-buying in several index heavyweights.

“Healthy monsoon progress, lower intensity of FII selling and robust macro data points like GST collection, services PMI data, have turned the sentiments positive. Impact of inflation on corporate earnings and management commentaries would be the key monitorable this results season.”

The rupee ended lower by 15 paise at 79.32 to the dollar tracking the latter’s strength in the overseas market.

The US Dollar Index which measures the unit against six other currencies was trading in the green at 107.25 against the previous close of 107.13.

MF downtrend

Inflows into equity mutual funds fell 16 per cent over the preceding month in June as investors turned cautious amid stock market volatility and persistent selling by foreign portfolio investors (FPIs).

Net inflow in June fell to Rs 15,498 crore in June from Rs 18,529 crore in May.

Equity schemes have seen net inflows since March 2021, reflecting the positive sentiment among domestic investors. Analysts said if it had not been for their support, the domestic markets would have seen a much greater crash.

All the equity-oriented categories received net inflows in June with the flexi-cap funds category being the biggest beneficiary with a net inflow of Rs 2,512 crore. This was followed by the multi-cap fund that saw Rs 2,130 crore net infusion.

However, the debt segment saw a net outflow of Rs 92,247 crore compared with a net withdrawal of Rs 32,722 crore in the preceding month.

Overall, the mutual fund industry registered a net outflow of Rs 69,853 crore last month compared with a net pullout of Rs 7,532 crore in May.

The outflow pulled down the average assets under management (AUM) of the industry to Rs 36.98 lakh crore at the end of June from Rs 37.37 lakh crore at May-end.