The market capitalisation of ITC crossed the Rs 5-lakh-crore (trillion) mark on a closing basis for the first time as the city-based conglomerate joins an elite club of companies to have reached the milestone.

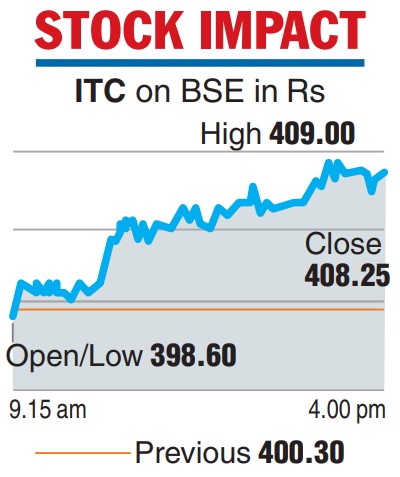

The ITC stock closed Rs 408.25 up 1.99 per cent or Rs 7.95 on the BSE. Market capitalisation at close stood at Rs 507,373 crore, seventh on the pecking order of companies.

On Friday, the tobacco-to-hotel major toppled India’s largest mortgage lender HDFC in valuation. ITC, led by CMD Sanjiv Puri, has been the best performer in the Nifty 50, handing out 56.78 per cent return in a year.

Many brokerages believe there could be more steam left on the counter. Motilal Oswal and ICICIdirect.co have a target of Rs 450, while Prabhudas Liladhar has a target of Rs 438.

The outperformance of the stock over the last two years — it almost doubled — was preceded by years of lull. The scrip broke into the Rs-300-bracket in May 2017, and investors have finally been rewarded with a relative outperformance to the broader indices in the last 24 months.

The growth in cigarette volumes in a stable tax regime over three years has been the key driver even as every segment — FMCG, hotels, paper & paper board, agri commodities — performed well.

In Q3 of last fiscal, cigarette volumes grew 15 per cent. Some analysts believe ITC would maintain double-digit growth by winning market share from illegal trade.

Abneesh Roy, director of institutional securities of Nuvama Institutional Equities, said volumes may grow 11-12 per cent and it has a target price of Rs 450 with the possibility of upgrade.

Roy believes the non-tobacco business would report good performance in Q4, barring agri-commodities. ITC has taken marginal price hikes in some of the cigarette brands. Nuvama has a 30 per cent weightage on ITC in its model FMCG portfolio.

Some analysts consider ITC’s valuation to be cheap compared with other Indian FMCG companies, but it is at par with its peers in the cigarette business globally. In the nine months ending December 31, cigarettes contributed 36.59 per cent to revenues and 75.42 per cent to profit.

However, the contribution from non-tobacco units is rising. Investors have been clamouring for the demerger of hotels. The management has said it would look at an alternative structure at an opportune time.