Mahindra & Mahindra on Friday reported a 44 per cent increase in consolidated profit at Rs 2,773 crore for the September quarter, driven by robust performance in automotive and farm equipment verticals.

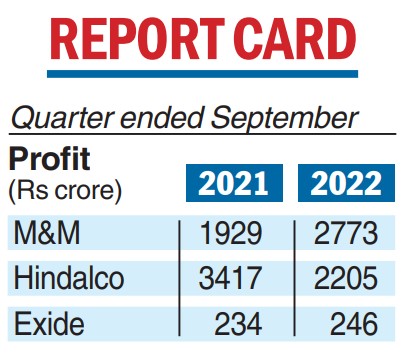

The group had logged a net profit of Rs 1,929 crore in July-September last fiscal year,. Revenues rose to Rs 29,870 crore from Rs 21,470 crore in the year-ago period.

The automotive segment’s revenue rose to Rs 15,231 crore from Rs 8,245 crore in the yearago period.

Similarly, revenue from the farm equipment segment increased to Rs 7,506 crore from Rs 6,723 crore.

Revenue from the financial services vertical rose to Rs 2,974 crore against Rs 2,909 crore, while the hospitality business posted a revenue of Rs 598 crore compared with Rs 560 crore in the year-ago quarter. The real estate segment saw a revenue of Rs 70 crore against Rs 59 crore in the yearago period.

Hindalco net declines

Hindalco Industries on Friday reported 35.4 per cent decline in consolidated profit after tax at Rs 2,205 crore for the quarter ended September mainly due to elevated input costs.

The company had posted a consolidated profit after tax of Rs 3,417 crore in the year-ago period.

However, consolidated revenues increased to Rs 56,176 crore from Rs 47,665 crore in the year-ago period.

Exide profit up 5%

Exide Industries on Friday reported a net profit of Rs 246 crore for the second quarter, a growth of 5.12 per cent from Rs 234 crore a year ago.

The company said its sales momentum remains healthy as revenue from operations grew 13 per cent year-on-year to Rs 3,719 crore from Rs 3,290 crore in Q2FY22, but high input costs continue to impact profit on a year-on-year basis.

The company, however, said that judicious pricing strategies along with sequential respite in input cost inflation have supported margins during the quarter.

“Demand scenario was upbeat, both in the replacement market and with the OEMs thereby driving volumes both in Q2FY23 and H1FY23. Improvement in the semiconductor supply situation led to demand recovery from OEMs. The industrial business vertical witnessed a strong recovery,” Exide said.