Most people at the end of their professional lives look forward to enjoy the benefits of their hard earned savings and lead stress free golden years. However, life after retirement doesn’t always run the way that one had envisaged or planned for.

With all the returns on investments comes the uninvited gift of taxes too. Disappointing as it may be, there are various taxes that take away a large amount of corpus from savings and thus it clearly calls out for a tax-efficient financial planning which will allow complete financial freedom after retirement.

Plan for these three taxes post retirement: As and when long-term investments mature and your investment preferences change, your tax scenario is likely to change once you retire. With regular pension, the following incomes form a major part of your taxable income:

• Rental income

• Income from the sale of assets or capital gains

• Income from other sources like interest and dividends

Income from house property

For most pensioners, rental income forms a major part of post-retirement income. For tax purposes, this income is usually classified as rental income.

Rental income from house property increases your gross taxable income which is charged according to your income tax slab.

Tax on capital gains

Capital gains are usually classified as taxable income if ...

• The asset that has been transferred is a capital asset;

• If you transferred the aforementioned asset at any time during the previous year;

• If you’ve gained certain profits or gains from said capital transfer

Capital gains are usually assessed based on the holding period of the asset and classified as either long-term or short-term capital gains. To check how capital gains are identified for taxation (under the current regime) see chart.

Income from interest, payout

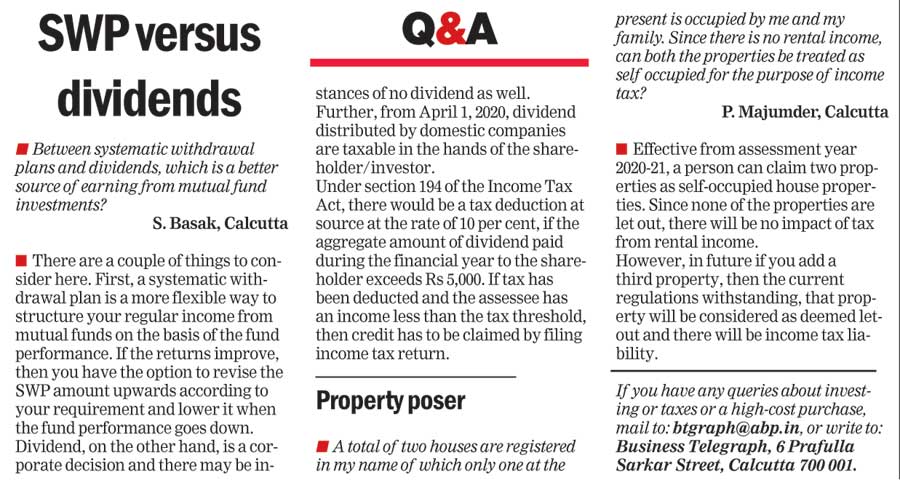

Depending on the portfolio, dividends and interest forms a major part of your post-retirement income. These are considered interest-bearing securities and from a large part of your taxable income and are taxed accordingly:

• For all investments in shares, dividends earned are taxable at 10 per cent

• Make sure to submit your PAN details to the payer. If this condition is not met, the payer will need to deduct tax at source at a rate of 20 per cent.

How do you lower taxes?

Although most of these taxes are largely unavoidable, their overall impact on your hard-earned savings can be mitigated. There are two major ways by which you can reduce the burden on your retirement income:

• Manage taxable income well:

One of the best ways to avoid your savings being axed is to plan your finances in a more tax-efficient manner. Thoughtful planning in advance can help reduce your taxes and will help you retain a substantial amount of your saving for your retirement.

Under the current provisions, the basic exemption limit is Rs 3 lakh for senior citizens. However, owing to the exemption under section 87A of the Income Tax Act, your tax liability can be zero for taxable income up to Rs 5 lakh.

For taxable income more than Rs 5 lakh, it can be managed efficiently with certain types of tax-saving investments on which deduction under section 80C of the Income Tax Act can claim.

This includes premium payment under a life insurance policy, Senior Citizen Fixed Deposits and Senior Citizen Savings Scheme. The maximum limit of deduction available under this section is Rs 1.5 lakh.

• Maximise non-taxable income

An individual can maximise non-taxable income by investing savings into investments which generate tax efficient returns and on which an individual can claim tax deductions.

One can maximise tax-free income by investing savings into tax-saving retirement plans that offer EEE tax benefits (Exempt Exempt Exempt)

Such investments are eligible for the following three tax exemptions:

Exemption 1: The amount invested is eligible for a deduction from taxable income.

Exemption 2: The interest accrued on savings corpus during the compounding phase is tax-exempt.

Exemption 3: The maturity value earned from investments is also tax-exempt at the time of withdrawal.

EEE benefit applies to mainly long-term investment instruments like life insurance plans, EPF and PPF, and ELSS. As the famous adage goes, “a penny saved, is a penny earned”.

Similarly, if we plan efficiently, we will be able to enjoy our golden years without feeling the brunt of taxes on our earning.

The writer is chief financial officer of Canara HSBC OBC Life Insurance