In her budget speech, finance minister Nirmala Sitharaman gave taxpayers an interesting choice: they now get to choose between two income tax regimes. One — the old one where you take tax deductions but pay a higher rate of tax. And two — a new regime that starts from April 2020, where you can’t claim deductions but pay a lower rate of tax. While the move was met with initial cheers, many taxpayers are now confused about which is the better regime.

The answer to this quandary varies from one taxpayer to another. People earn in different ways and are, hence, taxed in different ways. Salaried taxpayers are limited in the ways they can save taxes. Hence, for them, here’s a simplified formula to solve their quandary. It’s called the “20 per cent formula”.

Here’s how it is applied. First, we take stock of your income. Second, we take stock of all deductions available to you. And third, we calculate your taxes in the old regime with and without deductions, and then compare them with your taxes in the new regime.

But first, a disclaimer: this formula works well if your income is, say, between Rs 5 lakh and Rs 20 lakh. The higher your salary income, the more difficult it becomes for you to get additional deductions. Also, our calculations below are simplified for the sake of illustration, and the nature and quantum of your income will determine your final taxes.

Take stock of your income

So, before we know what your taxes are, we need to know your income. This is very important as incomplete income and tax deduction computations will not give an accurate picture. Let’s take the example of your income for 2019-20. Do note that your total income will include not just your salary but also your business income, capital gains from investments and interest earned on deposits. So, start with taking stock of your gross income.

Know your deductions

There’s a plethora of tax deductions available to you under the Income Tax Act. You must take a moment to understand the deductions you are eligible for because they help you save taxes.

Some well-known deductions include eligible investments and insurance purchases up to Rs 1.5 lakh under Section 80C, Rs 10,000 under Section 80TTA, medical expenses and health insurance purchases under Section 80D, education loan interest under Section 80E and so on. Deductions may also be earned without any investment or insurance. For example, Rs 50,000 as standard deduction, or deductions for rent, children’s school fees and eligible healthcare expenses.

Aim to get 20% deductions

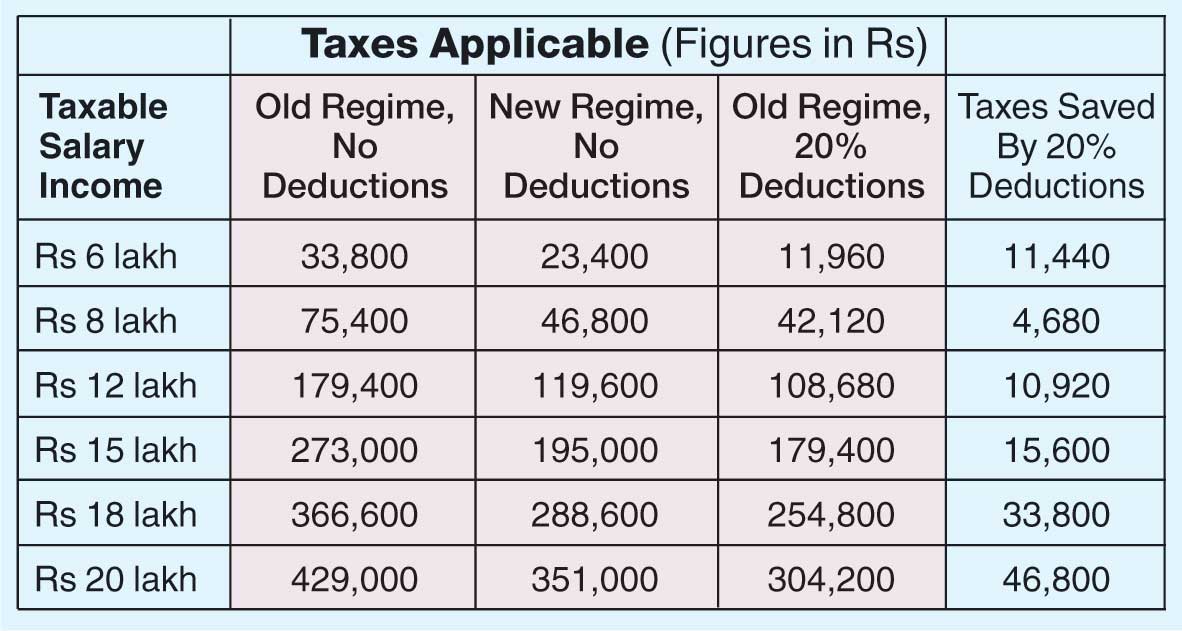

This is the key part. When you add up all your available deductions, do you get to at least 20 per cent of your gross income? If you do, you’re better off in the old regime where you would save more taxes. Let’s understand this with an example. Let’s say your gross salary is Rs 7.5 lakh. In the old regime, you’d pay Rs 65,000 as taxes without deductions. In the new regime, your taxes can come down to Rs 39,000 — clearly better. But when you deduct 20 per cent — or Rs 1.5 lakh — your taxes in the old regime fall to Rs 33,800. There’s one clear winner here. So, why give up on your deductions when you save so much tax through them?

Disclaimer

Now comes the disclaimer mentioned earlier. If your gross income is, say Rs 35 lakh and made up mostly of salary income, securing a 20 per cent deduction, that is Rs 7 lakh, will be really difficult. There aren’t enough tax deductions to accommodate this high threshold. Theoretically, though, the 20 per cent formula still applies. If high earners can get up to 20 per cent deductions, they too can benefit by remaining in the old regime. Else, they are better served by the new regime.

Let’s conclude by saying that you must do your math before you take your decision. Therefore, do not discontinue critical financial moves such as paying life and health insurance premiums or investing in tax-saving investments. When in doubt, don’t hesitate to consult your tax advisor.

The author is CEO, `BankBazaar.com`