On a day India’s largest initial public offer tanked on the bourses, voices from the government and brokerages rushed to soothe the frayed nerves of hapless investors, arguing LIC would fare well in the long run.

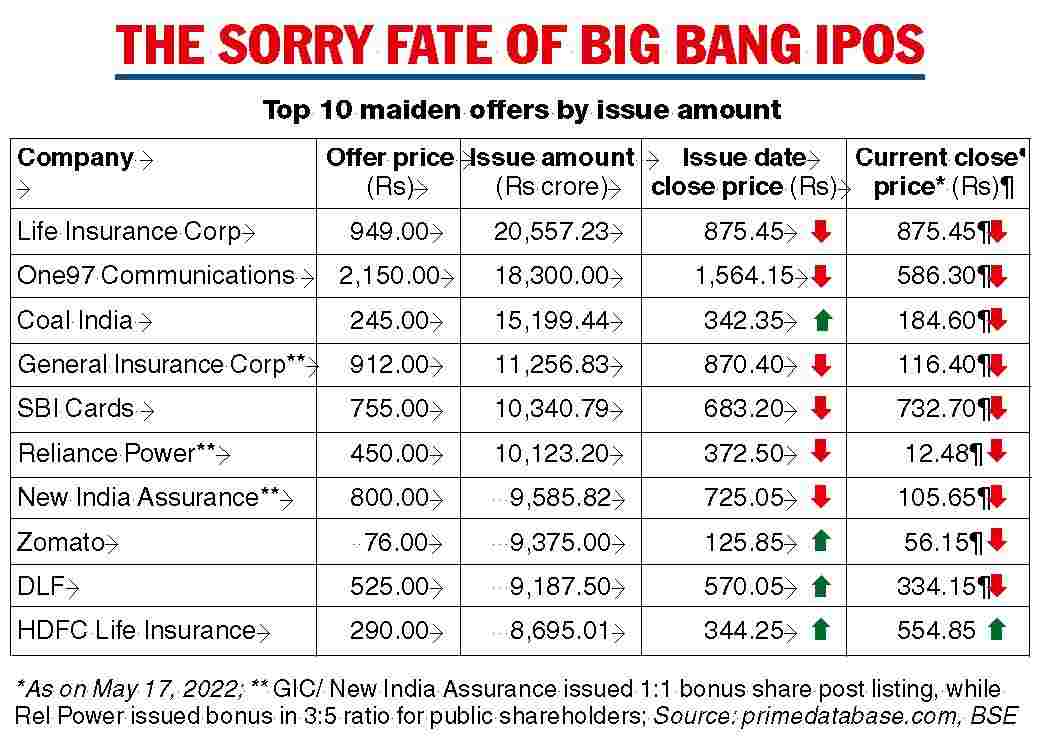

However, a look at the listing day performances of the big bang IPOs in the domestic market and their current market price belie the confidence exuded in the pep talk. Six out of the top 10 IPOs by issue size lost money for the investors on the basis of the closing price on the listing day (see chart).

If the closing price of these mega public issues are considered, only one of the top 10 IPOs has returned money for the investors, even though some of the stocks may have given them ample opportunity to make an exit with a profit.

For instance, Coal India’s Rs 15,199-crore IPO, which used to be India’s largest IPO since 2010 before One97 Communications Ltd (Paytm) broke it in 2021, not only opened with a premium but also the scrip remained above the issue price long enough allowing early bird investors an opportunity to exit with profit.

Real estate giant DLF and food delivery startup Zomato sizzled on their listing days and held on to gains for months allowing investors to make an informed call on their money.

As Pranav Haldea, managing director of Prime Database Group, a firm that tracks primary market performance, said, investors must get rid of the mindset that all IPOs should give positive returns till perpetuity.

“Once the IPO happens and the company gets listed, it becomes like any other listed company whose price goes up and down depending on how the company performs, what kind of quarterly results it gives, how the sector is doing, corporate governance etc,” Haldea told The Telegraph.

Market participants warn that it would not be prudent to write off LIC based on the Day -1 performance. Tuhin Kanta Pandey, secretary in the Department of Investment and Public Asset Management (DIPAM), blamed the unpredictable market condition for the tepid response, even though the indices jumped 2.54 per cent on Tuesday.

“Nobody can predict the market. We have been saying that it should not be held for a particular day but for more than a day,” Pandey said .

Girirajan Murugan, CEO of FundsIndia, said LIC is a long-term play and investors should not look at listing gains alone.

Any opportunity to add into LIC at a price lower than the IPO price should be used to invest more for the long term.

Macquarie had a word of caution: it suggested LIC had to change its business practice. Due to legacy reasons, LIC has largely sold just one product-participating (PAR) policies.

The management earlier never looked at profitability in terms of value of new business (VNB) margins, return on embedded value (RoEV).

Hence, to change the approach and start selling high margin non-par savings policies and pure protection products could be difficult, it said.

Divestment outlook

Analysts said future PSU divestments should take into consideration the impact of the Ukraine war on the global economy.

“The timing has become a key factor for the disinvestment programme. The LIC IPO would force the government to rethink and the success of future strategic sale and IPO would depend on the timing,” N.R. Bhanumurthy, vice-chancellor of B.R. Ambedkar School of Economics University, Bangalore, said.

The government plans to come out with the listing of three state-run companies in the current fiscal: Export Credit Guarantee Corp. of India (ECGC), WAPCOS and National Seeds Corp. Ltd.

Apart from that, it plans to go in for the strategic sale of Shipping Corporation of India, BEML, HLL Lifecare and PDIL in the current fiscal year.

(With inputs from Mumbai & Delhi Bureau)