Participating policies in life insurance, which offer bonus and pay dividend, are ceding ground to non-participating policies, which offer guaranteed benefits on death and policy maturity.

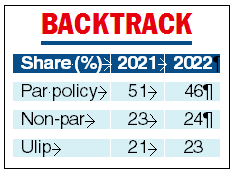

The industry has seen a shift in the product mix in 2021-22 with a decline in the share of participating (par) policies.

Data from Emkay Research show the share of participating policies in new business premiums has come down to 46 per cent in March 2022 from 51 per cent a year ago although the aggregate sum has increased.

A growing demand for guaranteed products amid low interest rates offered by banks on time deposits, additional savings being deployed by affluent customers and a buoyant equity market have contributed to the shift in the product mix.

“Opacity of par products have started to impact their acceptance among the informed mass, affluent and HNI customers. Additionally, after the recent fund bifurcation at LIC and its gradual shift to 90:10 surplus sharing, the attractiveness of LIC’s par products will also be reduced and hence par growth will likely to remain muted,” the research firm said .

“High yields offered in guaranteed products (including annuity) have contributed significantly to the growth of non par business. Pandemic has also resulted in customer preference shifting to guarantees which has boosted non par sales,” said Sameer Joshi, chief agency officer, Bajaj Allianz Life Insurance.

“LIC has a product mix which is predominantly par product based. Given the large size of the business and the fact that their growth has been relatively less than the industry, par business has seen a slow growth. ,” he added.

“The interest rates have gone up on debt instruments and the non par products have become more competitive compared to fixed deposits. While non par products were competitive earlier too, the gap in rates have widened now, said Sajja Praveen Chowdary, business head, term life insurance, Policybaazar.com

Besides, returns from fixed deposits are taxable whereas returns from non par products are tax free. The combined impact has led to attraction towards non par products. Ulips have also bounced back as the equity markets gained post Covid impact, Chowdary said.